Introduction

Capital structure analysis helps companies optimize their mix of debt and equity financing. Traditional analysis in Excel compares scenarios with different debt-to-equity ratios, calculates interest tax shields, and evaluates key metrics like the debt ratio and debt-to-equity ratio. Excel enables analysts to assess how a company's $1 billion total capitalization might perform under various financing structures.

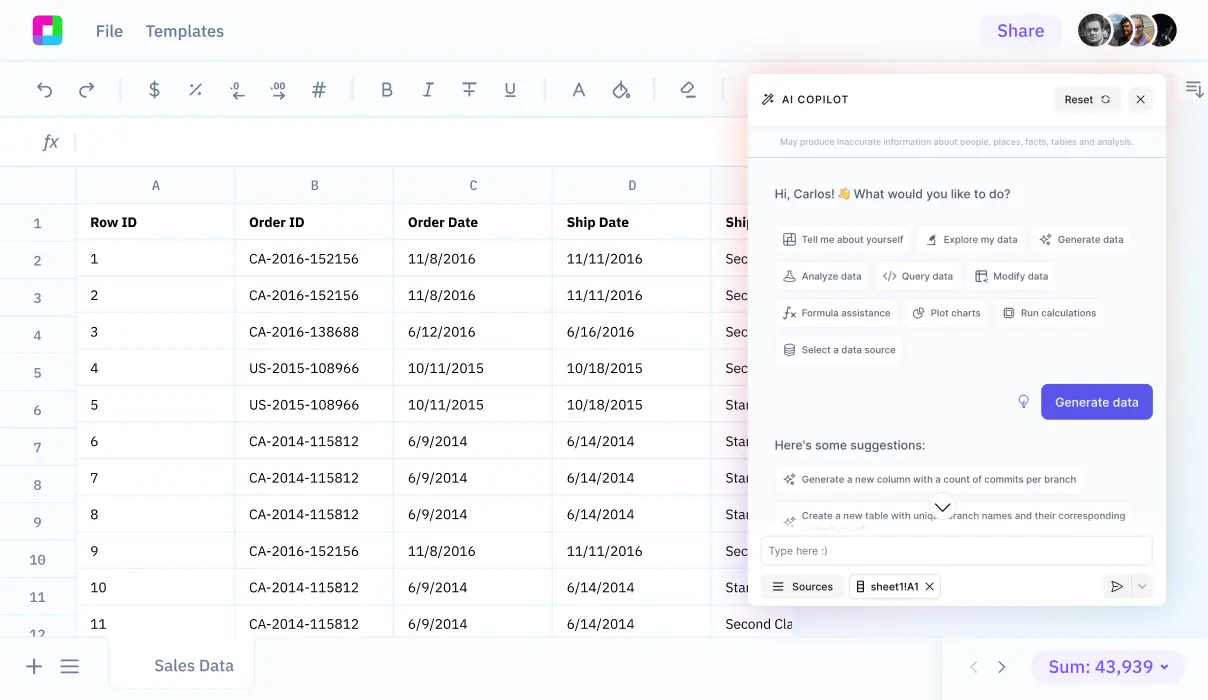

While Excel remains powerful, Sourcetable offers a revolutionary AI-powered alternative for capital structure analysis. This modern spreadsheet platform lets you chat with AI to analyze data, create visualizations, and generate insights without complex formulas or Excel expertise. Simply upload your financial data or connect your database, then tell Sourcetable's AI what analysis you need - it handles all the complexity automatically.

Learn how to leverage Sourcetable's AI-powered tools for efficient capital structure analysis at https://app.sourcetable.cloud/signup.

Why Sourcetable Is the Best Tool for Capital Structure Analysis

Sourcetable revolutionizes capital structure analysis through its conversational AI interface. While Excel requires manual function inputs and complex formulas, Sourcetable lets you simply describe your analysis needs in plain language. Upload your financial data or connect your database, and let AI handle the complexities.

Enhanced Analysis Capabilities

Capital structure decisions require complex scenario analysis, particularly when evaluating debt versus equity trade-offs. Rather than wrestling with Excel formulas, Sourcetable's AI chatbot automatically performs data analysis, financial forecasting, and calculations like tax advantages of debt (Interest × Tax Rate) through simple conversations.

Superior Data Visualization

Sourcetable transforms complex financial data into stunning visualizations with a simple request. Unlike Excel's manual charting process, Sourcetable's AI creates and modifies visualizations instantly based on your natural language descriptions, making it easier to communicate capital structure recommendations across organizations.

Automated Workflow Benefits

Traditional Excel analysis requires deep formula knowledge and manual updates. Sourcetable eliminates this complexity by letting you generate spreadsheets, perform analysis, and create reports through natural conversation with AI. This approach reduces errors, saves time, and makes sophisticated financial analysis accessible to everyone.

Benefits of Capital Structure Analysis with Sourcetable

Why Analyze Capital Structure

Capital structure analysis helps investors and analysts assess a company's financial health and investment potential. By examining key ratios like debt ratio, debt-to-equity ratio, and long-term debt-to-capitalization ratio, analysts can evaluate borrowing practices, credit risk, and growth opportunity utilization. This analysis reveals if a company effectively manages its debt and equity while optimizing its cost of capital.

Advantages of Using Sourcetable

Sourcetable's AI-powered platform revolutionizes capital structure analysis through natural language interactions. Simply tell the AI what financial metrics you want to analyze, and it handles the complex calculations and data processing automatically. Upload your financial data files or connect your database, and let Sourcetable's AI transform your data into meaningful insights with minimal manual effort.

Sourcetable vs. Excel

Sourcetable eliminates the need for complex Excel functions and manual calculations. Instead of wrestling with formulas and features, you can simply describe your analysis needs to the AI. The platform excels at handling large financial datasets and automatically generates stunning visualizations and reports. This AI-driven approach enables more strategic financial analysis while significantly reducing the time spent on technical spreadsheet work.

Capital Structure Analysis with Sourcetable: A Modern AI-Powered Alternative to Excel

Sourcetable's AI chatbot simplifies capital structure analysis by automating complex calculations like debt ratio (total debt / total assets), debt-to-equity ratio (total debt / total shareholders' equity), and long-term debt to capitalization ratio (long-term debt / total capitalization).

AI-Powered Analysis Features

Simply upload your financial data or connect your database, then tell Sourcetable's AI what analysis you need. The AI chatbot handles financial modeling, generates visualizations, and provides clear explanations of calculations without requiring manual formula input.

Conservative vs Aggressive Analysis

Through natural language commands, Sourcetable analyzes whether a company's capital structure is conservative (more equity than debt) or aggressive (more debt than equity). This analysis helps determine optimal capital structure that maximizes market value while minimizing cost of capital.

Investment Assessment

The platform evaluates companies as potential investments by analyzing credit risk, growth opportunity utilization, and cost of capital efficiency. Simply describe the analysis you need, and Sourcetable's AI will examine multiple metrics including debt ratios and credit agency ratings to determine financial strength.

Capital Structure Analysis Use Cases with Sourcetable

Conversational Capital Ratio Analysis |

Ask Sourcetable's AI chatbot to calculate and explain key metrics including |

AI-Guided Structure Assessment |

Use natural language conversations with Sourcetable's AI to analyze capital structure quality and determine optimal leverage levels, with automated visualization of key insights. |

Simplified Financial Modeling |

Create three-statement financial models by simply describing your requirements to Sourcetable's AI chatbot, which handles data processing and analysis from your uploaded files or connected database. |

Visual Capital Structure Monitoring |

Request Sourcetable's AI to generate and maintain dynamic visualizations of capital structure metrics, enabling intuitive analysis of company leverage and financial health. |

Frequently Asked Questions

What is Capital Structure Analysis?

Capital Structure Analysis is the examination of a company's mix of debt and equity financing that funds its operations. It helps determine if a company has the right balance of financing sources to optimize its cost of capital and maximize shareholder value.

Why is Capital Structure Analysis important?

Capital Structure Analysis is important because it helps investors and analysts determine if a company is a strong investment, assess if it has too much debt or equity, evaluate if it's underutilizing growth opportunities, and determine if it's paying too much for its cost of capital. It's crucial for making informed investment decisions and understanding a company's financial health.

How can you perform Capital Structure Analysis?

Capital Structure Analysis can be performed using several methods: calculating financial ratios like debt-to-equity and interest coverage ratios, assessing cost of capital, conducting break-even analysis, and using scenario and sensitivity analyses. Specific ratios include Equity Ratio, Debt Ratio, and Debt-to-Equity Ratio, with the basic formula being (Equity / Debt) x 100.

What are the different approaches to analyzing capital structure?

There are two main approaches to analyzing capital structure: vertical and horizontal. Vertical capital structure compares equity and debt to total capital, while horizontal capital structure compares equity to fixed assets and debt to current assets. Both approaches help provide a comprehensive understanding of a company's financial structure.

Conclusion

Capital structure analysis is essential for evaluating a company's financial health through its mix of debt and equity. Traditional Excel analysis compares scenarios, such as an all-equity structure versus a 50/50 debt-to-equity ratio, using metrics like EBIT ($200 million), interest rates (6%), and tax implications (25%). Key ratios, including debt-to-equity and credit ratings from agencies like Moody's and S&P, provide further insights into optimal capital structure.

While Excel remains a powerful tool, Sourcetable provides an innovative AI-powered alternative that transforms capital structure analysis. By leveraging its built-in AI chatbot, Sourcetable eliminates the need for complex Excel functions and formulas. Users can upload their financial data or connect their database, then simply tell the AI what analysis they need. The platform automatically generates insights, creates visualizations, and performs complex calculations without requiring Excel expertise.

Experience how Sourcetable's AI chatbot simplifies capital structure analysis through natural language interactions. Try it today at https://app.sourcetable.cloud/signup.