Introduction

Common Size Analysis, also called vertical analysis, expresses financial statement line items as percentages of a base amount. This analysis helps compare companies of different sizes and track performance over time. In a balance sheet, total assets serve as the base amount, while total revenues anchor income statement calculations.

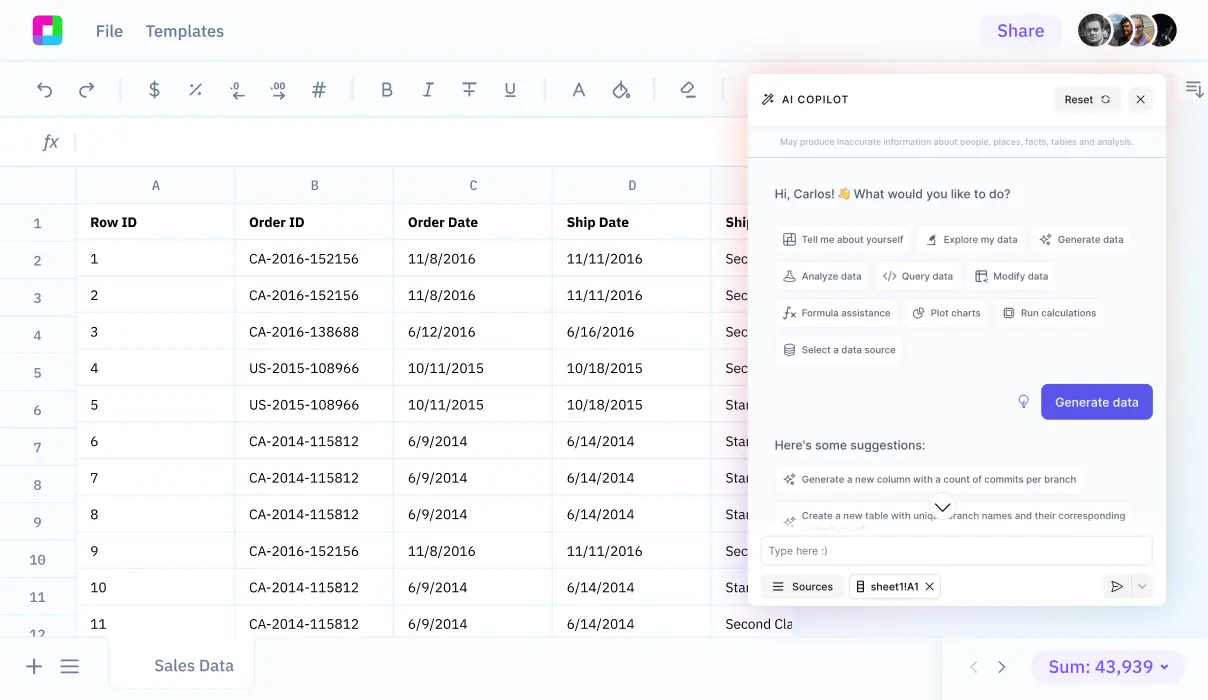

While Excel has traditionally been the tool of choice for Common Size Analysis, requiring manual calculations and complex formulas, modern AI alternatives like Sourcetable eliminate these challenges. Sourcetable's AI chatbot guides you through the analysis process - simply upload your financial data and tell the AI what insights you need. The AI assistant handles all calculations, data cleaning, and visualization tasks.

Learn how to perform Common Size Analysis effortlessly with Sourcetable's conversational AI interface - try it now.

Why Sourcetable Is the Best Tool for Common Size Analysis

Sourcetable revolutionizes Common Size Analysis by replacing complex Excel functions with natural language interaction. Instead of manual calculations using line item / base item, users simply tell Sourcetable's AI chatbot what analysis they need, and it handles all calculations automatically.

Superior Data Analysis

Unlike Excel's function-based approach, Sourcetable lets you upload files or connect databases and interact with your data through simple conversation. The AI understands common size analysis requirements and automatically processes your financial data without complicated formulas.

Enhanced Analysis Capabilities

Sourcetable excels at both vertical and horizontal common size analysis, instantly generating insights from balance sheets, income statements, and cash flow statements. Its AI capabilities automate data cleaning, scenario analysis, and financial forecasting—tasks that require extensive manual effort in Excel.

Better Performance Tracking

Financial managers can track performance changes effortlessly by asking Sourcetable's AI to generate visualizations and reports. Simply describe the insights you need, and Sourcetable creates dashboards that identify successful strategies and compare performance against competitors.

Simplified Workflow

While Excel requires manual formula creation and formatting, Sourcetable's AI chatbot handles all technical aspects of common size analysis. Users can focus on interpreting results and making strategic decisions rather than managing spreadsheet mechanics.

Benefits of Common Size Analysis with Sourcetable

Common Size Analysis Advantages

Common size analysis, also known as vertical analysis, is a powerful financial analysis tool that expresses line items as percentages of base amounts. For balance sheets, total assets serve as the base, while total revenues are the base for income statements. The analysis uses the formula line item amount/base item amount to evaluate financial statements.

This analysis method enables investors to identify significant changes in financial statements and compare companies of different sizes within the same industry. It reveals company strategies and major expenses that create competitive advantages. The analysis can be applied to balance sheets, income statements, and cash flow statements.

Sourcetable vs Excel for Common Size Analysis

Sourcetable's AI chatbot interface revolutionizes common size analysis by eliminating the need for complex Excel functions. Simply upload your financial data or connect your database, then tell Sourcetable what analysis you need. The AI automatically performs calculations, generates insights, and creates stunning visualizations of your financial data.

While Excel requires manual formula input and formatting, Sourcetable's natural language processing capabilities let you create and analyze spreadsheets through simple conversation. This AI-driven approach makes common size analysis faster and more accessible, whether you're analyzing historical data or generating financial reports.

Common Size Analysis Examples with Sourcetable

Sourcetable's AI-powered interface enables common size analysis through natural language commands. Simply upload your financial data or connect your database, then tell Sourcetable what analysis you need. The AI chatbot handles all calculations and transformations automatically.

Balance Sheet Analysis

Request vertical analysis using total assets as the base item to understand the proportion of individual assets and liabilities. This helps identify significant changes in a company's financial position and compare firms of different sizes within the same industry.

Income Statement Analysis

Ask Sourcetable to calculate key metrics like net profit margin, gross margin, and operating margin using total revenue as the base. Compare the proportion of revenues spent on advertising and R&D against competitors to reveal competitive advantages and strategic differences.

Cash Flow Statement Analysis

Direct Sourcetable's AI to analyze cash flow statements and track the relative importance of operating, investing, and financing activities over time. This helps investors identify trends and make informed investment decisions based on two to three years of financial data.

AI-Powered Analysis Features

Sourcetable eliminates manual Excel functions through conversational AI interactions. Simply describe your analysis needs, and the AI will generate the appropriate calculations, visualizations, and insights across all financial statements.

Use Cases for Common Size Analysis with Sourcetable

Industry Competitor Analysis |

Upload financial statements from multiple companies and ask Sourcetable's AI to perform comparative analysis. The AI will automatically convert statements to percentages and highlight key differences in resource allocation across competitors. |

Capital Structure Evaluation |

Connect your financial database to Sourcetable and request AI-driven analysis of capital structure metrics. The AI will calculate key ratios like |

Performance Trend Analysis |

Import historical financial data and let Sourcetable's AI identify significant trends. The AI automatically converts statements to percentages and tracks changes in crucial metrics like |

Strategic Investment Analysis |

Upload potential investment target data and ask Sourcetable's AI to perform comprehensive common size analysis. The AI will analyze profitability metrics like |

Frequently Asked Questions

What is Common Size Analysis and why is it useful?

Common-size analysis is a method that displays financial statement line items as a percentage of a base figure, such as total assets for the balance sheet or total revenue for the income statement. It's valuable because it makes it easier to analyze a company over time and compare it to peers, regardless of company size, while helping spot trends that raw financial statements might not reveal.

What are the two main types of Common Size Analysis?

Common size analysis can be conducted through vertical analysis and horizontal analysis. Vertical analysis examines line items in relation to a base item within the same financial period, while horizontal analysis compares line items to similar ones across different financial periods.

How can Sourcetable help with Common Size Analysis?

Sourcetable makes Common Size Analysis simple through its AI-powered interface. Just upload your financial data or connect your database, then tell Sourcetable's AI chatbot what analysis you want to perform. The AI will automatically handle the calculations, create visualizations, and generate insights from your data - no complex formulas or manual work required.

Conclusion

Common Size Analysis, also called vertical analysis, expresses financial statement line items as percentages of a base amount. In balance sheets, total assets serve as the base, while total revenues serve as the base in income statements. The formula line item amount / base amount calculates each percentage.

While Excel requires manual calculations for Common Size Analysis, Sourcetable provides an AI-powered alternative. Simply upload your financial statements and ask Sourcetable's AI chatbot to perform the analysis. The AI assistant handles all calculations, data cleaning, and visualization creation - no spreadsheet skills required. Try Sourcetable's conversational approach to financial analysis at https://app.sourcetable.cloud/signup.