Introduction

Cost basis analysis, essential for calculating capital gains and tax obligations, traditionally requires complex Excel formulas like SUMPRODUCT with multiple conditions. While Excel remains a powerful tool for tracking stock purchases and computing weighted average cost basis, modern AI alternatives streamline this process.

Open-source financial data tools have democratized sophisticated financial analysis, allowing broader access to valuable market insights and advanced predictive modeling. Sourcetable emerges as an innovative solution, leveraging AI to eliminate the need for complex Excel functions while delivering powerful analytical capabilities through simple conversation.

From basic cost basis calculations to complex financial modeling, Sourcetable's AI chatbot interface allows you to analyze data by simply describing what you want to learn. Transform your approach to cost basis analysis by signing up today.

Why Sourcetable Is Superior for Cost Basis Analysis

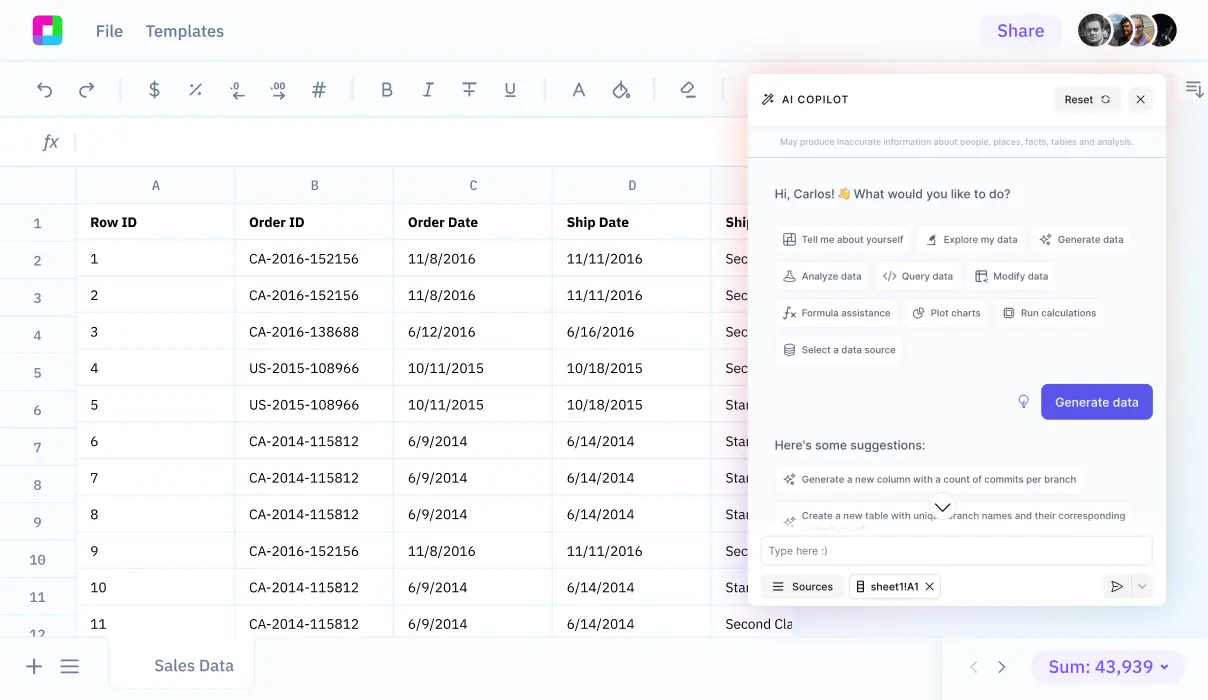

Sourcetable's AI-powered platform transforms cost basis analysis by letting you interact naturally with your data. Unlike Excel's complex formulas (SUM(price * shares) / total_shares) and manual processes, Sourcetable's chatbot interface lets you analyze cost basis through simple conversation.

While Excel requires mastery of functions and formulas for cost basis calculations, Sourcetable eliminates this learning curve. Simply upload your trading data or connect your database, then tell the AI what analysis you need. The platform's ability to handle files of any size overcomes Excel's size limitations.

Tax Optimization Benefits

Sourcetable's conversational AI interface makes tax optimization intuitive. Instead of wrestling with Excel formulas, you can ask the AI to analyze different tax lot methods and identify opportunities to minimize your tax burden through natural language commands.

Advanced Data Processing

Sourcetable replaces Excel's tedious manual processes with AI-powered analysis. Upload your data files or connect your database, and let the AI transform your cost basis data into clear visualizations and insights through simple conversation. This approach makes complex financial analysis accessible to everyone, not just spreadsheet experts.

Benefits of Cost Basis Analysis with Sourcetable

Cost-benefit analysis (CBA) is a data-driven decision-making technique that evaluates both financial and non-financial outcomes. CBA strengthens findings by requiring comprehensive research across all costs, including harder-to-measure project aspects.

Why Choose Sourcetable for Cost Basis Analysis

Sourcetable's AI-powered platform transforms cost basis analysis through natural language interaction. Simply upload your data files or connect your database, then tell the AI what analysis you need. This intuitive approach eliminates the complexity of traditional Excel functions and formulas.

The Tax Lot Optimizer in Sourcetable automates cost basis analysis with high tax efficiency. It follows a strategic selling order: short-term losses first, followed by long-term losses, then short-term gains, and finally long-term gains. This automated approach requires less effort than manual share selection.

Data Visualization and Real-Time Updates

Sourcetable excels at creating dashboards and charts through simple AI conversations. Tell the AI what visualizations you want, and it transforms your data into stunning charts and graphs. This natural language approach makes data visualization more accessible and efficient than Excel's traditional chart-building process.

Cost Basis Analysis Methods in Sourcetable

Sourcetable, an AI-powered spreadsheet, simplifies cost basis analysis through natural language interactions. Instead of complex formulas and manual calculations, users can instruct Sourcetable's AI chatbot to perform their desired analysis on uploaded files or connected databases.

Specific Lot Method

The specific lot method provides maximum flexibility in choosing which shares to sell. Through simple conversational commands, users can direct Sourcetable to analyze and select individual lot IDs to optimize tax outcomes.

Average Cost Method

Using the formula total cost / total shares, Sourcetable's AI can automatically calculate average costs across all held shares, eliminating manual computation needs.

Tax Lot Optimization

With natural language prompts, users can instruct Sourcetable to analyze and optimize tax lots, prioritizing tax-efficient selling strategies. The AI handles complex calculations to minimize tax liability while maximizing investment returns.

AI-Enhanced Analysis

Sourcetable's AI chatbot can generate visualizations, perform complex calculations, and analyze cost basis data from any uploaded spreadsheet or connected database. Users simply describe their analysis needs, and Sourcetable's AI delivers the results.

Cost Basis Analysis Use Cases with Sourcetable

Real-Time Portfolio Cost Basis Tracking |

Upload your portfolio data files and ask Sourcetable's AI to calculate weighted average cost basis across multiple stock purchases. The AI chatbot generates all necessary formulas and analysis automatically, providing instant portfolio insights. |

Tax-Efficient Investment Management |

Connect your investment database or upload transaction files and let Sourcetable's AI track all cost basis records for tax reporting. Simply ask the AI to analyze share purchases, sales, and dividend reinvestments for optimal tax planning. |

Multi-Asset Cost Basis Analysis |

Tell Sourcetable's AI to calculate and monitor cost basis across stocks, bonds, mutual funds, and real estate investments from your uploaded data. Generate comprehensive investment performance reports and visualizations through natural language requests. |

Automated Cost Basis Reporting |

Upload your investment data and ask Sourcetable's AI to generate detailed cost basis reports. The AI handles all calculations and creates stunning visualizations to track investment performance and profitability without manual formula creation. |

Frequently Asked Questions

What is Cost Basis Analysis and why is it important?

Cost basis analysis is the process of tracking the original value of assets for tax purposes, typically based on the purchase price. It's crucial for smart tax planning and can save thousands in taxes. The analysis helps determine capital gains and makes it easier to make investment decisions, including when to sell shares and whether to reinvest dividends.

How can I use Sourcetable's AI capabilities to perform Cost Basis Analysis?

Sourcetable's AI chatbot makes Cost Basis Analysis simple - just upload your financial data files or connect your database, then tell the AI what analysis you need. The AI will automatically process your data and can perform various cost basis calculations, create visualizations, and generate comprehensive reports. You don't need to know complex spreadsheet functions or formulas; simply describe what you want to analyze in natural language.

What methods are available for Cost Basis Analysis calculations?

There are several standard methods for cost basis calculations including average cost method, first-in first-out (FIFO), last-in first-out (LIFO), low-cost lot method, high-cost lot method, Tax Lot Optimizer, and specified lot method. With Sourcetable's AI, you can simply describe which method you want to use in natural language, and it will automatically perform the calculations and generate the appropriate reports and visualizations.

Conclusion

Cost basis analysis helps track investment performance and tax obligations. While Excel enables cost basis tracking through SUMPRODUCT formulas and weighted average calculations, these manual processes can be time-consuming and error-prone. Modern AI alternatives like Sourcetable simplify this analysis through natural language interactions with an AI chatbot.

Sourcetable eliminates the complexity of cost basis analysis by letting you describe what you want to analyze in plain English. Simply upload your investment data or connect your database, and Sourcetable's AI will generate the necessary calculations, formulas, and visualizations automatically. Try Sourcetable's conversational approach to cost basis analysis at https://app.sourcetable.cloud/signup.