Introduction

Debt Capacity Analysis is a critical financial metric that determines how much debt a company can safely take on while maintaining its ability to repay lenders. This analysis traditionally relies on key metrics like EBITDA and cash flow stability, with the Debt to EBITDA Ratio indicating how many years it would take to repay debt using EBITDA. While Excel has long been the standard tool for this analysis, it requires extensive formula knowledge and manual updates.

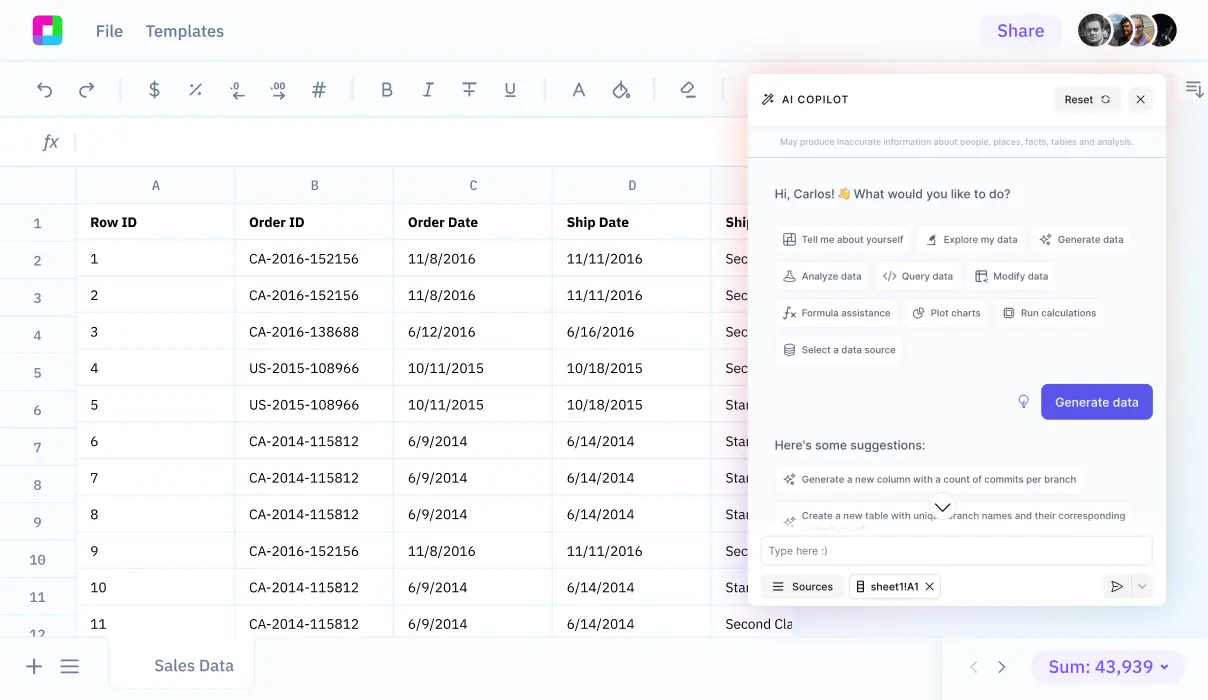

Sourcetable revolutionizes this process with its AI-powered spreadsheet platform. Unlike traditional Excel analysis, Sourcetable lets you interact with an AI chatbot to analyze data, create visualizations, and generate insights without complex formulas or functions. Simply upload your financial data or connect your database, and tell the AI what analysis you need - Sourcetable handles the rest, making complex financial analysis accessible to all skill levels.

Ready to streamline your Debt Capacity Analysis? Learn how Sourcetable's AI assistant helps you assess debt capacity metrics through natural conversation at https://app.sourcetable.cloud/signup.

Why Sourcetable Is Superior for Debt Capacity Analysis

Sourcetable revolutionizes debt capacity analysis through its AI-powered spreadsheet platform. Unlike Excel, which requires complex formulas and manual calculations, Sourcetable lets you analyze debt capacity through natural language conversations with an AI chatbot.

Simplified Analysis Process

While Excel demands expertise in financial formulas and functions, Sourcetable allows users to upload their financial data and simply ask the AI what they want to analyze. This streamlined approach reduces human error and improves accuracy in debt capacity calculations, crucial for determining optimal borrowing levels.

Enhanced Analysis Capabilities

Sourcetable's AI capabilities enable faster, more intuitive debt capacity analysis compared to Excel's complex functionality. Users can generate instant insights by asking questions about their data in plain English, eliminating the need to master spreadsheet functions.

Improved Decision Making

By combining conversational AI with powerful data visualization capabilities, Sourcetable helps companies make better decisions about debt financing. Users can quickly analyze expansion plans, acquisition capabilities, and capital expenditure needs by simply asking the AI to create relevant charts and calculations from their uploaded data.

Benefits of Debt Capacity Analysis with Sourcetable: A Modern Approach

Debt capacity analysis helps businesses determine optimal debt levels for acquisitions, expansions, and new projects. This critical analysis measures a company's ability to take on and repay debt through key metrics like EBITDA, debt-to-equity ratios, and cash flow coverage.

Why Choose Sourcetable Over Excel

While Excel remains common for financial analysis, Sourcetable's AI-powered approach transforms debt capacity assessment. Instead of wrestling with complex Excel functions and formulas, Sourcetable lets you interact with an AI chatbot to analyze your data and create stunning visualizations.

Sourcetable accepts data uploads of any size and connects to databases, eliminating manual data handling. Simply tell the AI what analysis you need, and it automatically processes your financial data and generates insights.

Key Metrics Made Simple

Sourcetable simplifies the calculation of essential debt capacity metrics including Total Debt/EBITDA, debt-to-equity ratios, and interest coverage ratios. Its AI understands natural language requests, making complex financial analysis accessible and efficient.

Advanced AI features automatically check for errors, categorize financial data, and generate predictive insights, improving accuracy and efficiency in debt capacity calculations. This automation allows analysts to focus on interpreting results rather than managing spreadsheets.

Debt Capacity Analysis Examples with Sourcetable

Sourcetable, an AI-powered spreadsheet platform, simplifies debt capacity analysis through natural language interactions. Simply upload your financial data or connect your database, then tell the AI what analysis you need.

EBITDA Analysis

Tell Sourcetable's AI to analyze debt capacity using EBITDA metrics and evaluate stability. The AI will automatically calculate Total Debt/EBITDA, including breakdowns of senior and subordinated debt components.

Cash Flow Metrics

Request cash flow analysis from Sourcetable's AI chatbot with a simple prompt. The system will generate cash interest coverage ratios and EBITDA-CapEx interest coverage, calculated as EBITDA - Capital Expenditures / Interest Coverage.

Balance Sheet Analysis

Ask Sourcetable to assess credit metrics like debt-to-equity ratios. The AI instantly analyzes capital structure and generates fixed-charge coverage ratios for debt capacity evaluation.

Cash Flow Assessment

Direct Sourcetable's AI to calculate cash flow proxies and evaluate borrower risk. The platform combines operating cash flow and proxy analysis to deliver comprehensive debt capacity insights.

Use Cases for Debt Capacity Analysis with Sourcetable

Automated Debt-to-EBITDA Analysis |

Simply tell Sourcetable's AI chatbot to analyze your uploaded financial data and calculate |

Cash Flow-Based Debt Capacity Automation |

Ask Sourcetable's AI to analyze Free Cash Flow from your database or spreadsheet files and calculate debt capacity by applying the after-tax cost of debt discounting methodology. |

Debt Covenant Compliance Monitoring |

Use natural language commands to instruct Sourcetable's AI to track and analyze debt covenant compliance metrics, automatically generating compliance reports for stakeholders. |

Collection Rate Optimization |

Direct Sourcetable's AI to analyze historical collection data and test different scenarios, delivering insights on optimal debt collection strategies and customer segmentation approaches. |

Frequently Asked Questions

What is Debt Capacity Analysis and why is it important?

Debt Capacity Analysis determines the maximum amount of leverage a company can sustainably manage based on its free cash flow profile and market positioning. It helps assess how much debt a company's cash flows can realistically handle using credit metrics like total leverage ratio, senior debt ratio, and interest coverage ratio.

What are the key financial metrics used in Debt Capacity Analysis?

Key metrics include total debt-to-EBITDA, senior debt-to-EBITDA, interest coverage ratio (EBIT/interest expense), debt-to-equity ratio, cash interest coverage, EBITDA-CapEx interest coverage, and fixed-charge coverage ratio. These metrics are analyzed using balance sheet and cash flow statement data.

How can Sourcetable's AI capabilities help with Debt Capacity Analysis?

Sourcetable's AI chatbot interface allows you to perform Debt Capacity Analysis by simply describing what you want to analyze in natural language. After uploading your financial data files or connecting your database, you can ask Sourcetable to calculate key metrics, generate visualizations, and create comprehensive financial reports without needing to know complex spreadsheet functions or formulas. The AI will handle all the analysis and presentation for you.

Conclusion

Debt Capacity Analysis remains a critical financial metric for assessing a company's ability to take on and repay debt. While Excel provides traditional tools for this analysis through templates and formulas like Debt to EBITDA = Total Debt / EBITDA, modern AI-powered alternatives like Sourcetable eliminate the complexity of spreadsheet analysis. Rather than navigating Excel's complex formulas and features, users can simply tell Sourcetable's AI chatbot what they want to analyze, and it handles the rest.

Sourcetable's AI-driven approach transforms how analysts perform debt capacity calculations. By uploading financial data files or connecting databases, users can leverage Sourcetable's AI to generate insights, create visualizations, and analyze debt capacity metrics through natural conversation. This conversational approach to financial analysis, combined with Sourcetable's ability to handle data files of any size, makes it a powerful alternative to traditional Excel-based debt capacity analysis.