Introduction

Dollar Roll Analysis is a bearish trading strategy in the mortgage-backed securities (MBS) market that profits when securities decrease in value. The analysis traditionally requires complex Excel calculations using templates to determine potential profits from short-selling MBS positions. While Excel-based dollar roll calculators can process factors like WAM adjustments and $100 million MBS positions, modern AI-powered alternatives offer enhanced efficiency.

Recent market data shows significant improvements in TBA monthly roll liquidity, with average bid/ask spreads tightening to less than 1/32 for key coupons. CME Group's 30-Year UMBS TBA futures provide transparent pricing and efficient calendar spreads with minimal counterparty risk. These market conditions make dollar roll analysis increasingly relevant for MBS traders.

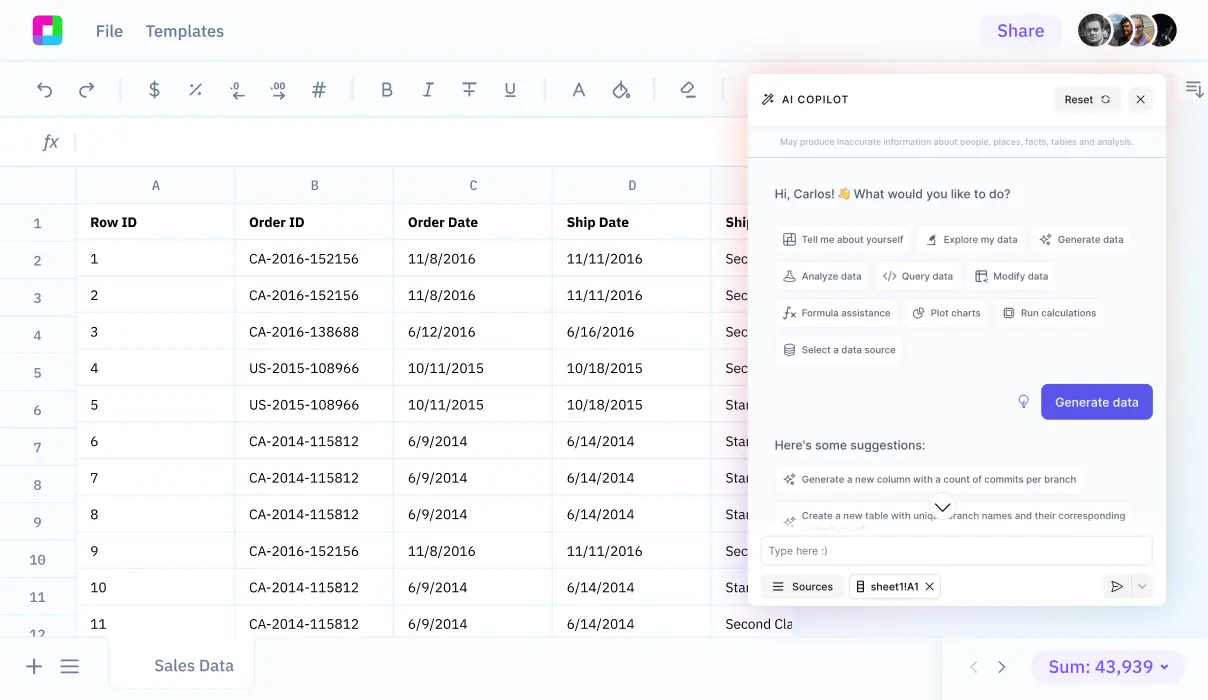

Sourcetable, an AI-powered spreadsheet platform, eliminates the need for complex Excel functions by letting you interact with an AI chatbot to perform dollar roll analysis through natural conversation. Simply upload your data or connect your database, describe your analysis goals to the AI, and Sourcetable will handle the calculations and generate insights automatically. Experience conversational Dollar Roll Analysis with Sourcetable at https://app.sourcetable.cloud/signup.

Why Sourcetable Excels at Dollar Roll Analysis

Sourcetable revolutionizes dollar roll analysis by replacing Excel's complex functions with an intuitive AI chatbot interface. Instead of manually creating pivot tables and formulas in Excel, users simply tell Sourcetable what they want to analyze.

By uploading TBA market data files or connecting databases, Sourcetable's AI instantly processes dollar roll calculations that would require extensive manual setup in Excel. The platform automatically analyzes bid/ask spreads and position data through natural conversation, eliminating Excel's steep learning curve.

Sourcetable's AI chatbot understands requests to calculate P&L using the formula sum(long roll positions) and generates visualizations of TBA calendar spreads instantly. This conversational approach replaces Excel's complex manual formula building and chart creation process.

The platform transforms dollar roll analysis by letting users request specific insights through natural dialogue. Whether tracking block trade requirements or monitoring liquidity trends, Sourcetable's AI generates instant, accurate analysis that would require extensive Excel expertise to replicate.

Dollar Roll Analysis Benefits: Excel vs Sourcetable AI-Powered Spreadsheets

Dollar Roll Analysis provides essential cash flow benefits to initiators. When performed in Sourcetable's AI-powered platform, this analysis becomes more efficient and accessible than traditional Excel methods.

Enhanced Data Management

While Excel tables offer basic features like automatic filtering, formula fill-down, and Power Query integration, Sourcetable transforms data analysis through conversational AI. Simply upload your data files or connect your database, then tell Sourcetable's AI chatbot what analysis you need, and it handles the complexities automatically.

Natural Language Processing Advantages

Sourcetable eliminates the need for complex Excel functions and features. Instead of learning formulas, users can simply describe their Dollar Roll Analysis needs in plain language to the AI chatbot, which then executes the calculations and analysis instantly.

Advanced Visualization Capabilities

Unlike Excel's manual chart creation process, Sourcetable can generate stunning visualizations through simple natural language requests. Tell the AI what insights you want to visualize from your Dollar Roll Analysis, and it creates the appropriate charts and visual representations automatically.

Dollar Roll Analysis Examples Using Sourcetable AI

Sourcetable's AI chatbot interface simplifies dollar roll analysis by allowing users to describe their analytical needs in natural language. The platform enables comprehensive analysis of various dollar roll types, including reverse repurchase agreements, fixed coupon transactions, and GNMA forward contracts.

Types of Analysis

Through natural language commands to Sourcetable's AI, users can analyze Type 1 reverse repurchase agreements that return identical securities, and Type 2 fixed coupon dollar reverse repurchase agreements. The AI understands requests to evaluate Type 3 fixed coupon agreements rolled at maturity and Type 4 forward commitment dollar rolls.

AI-Powered Features

Users can upload spreadsheet files or connect databases containing mortgage-backed securities data, then direct Sourcetable's AI to analyze GNMA, Freddie Mac, and Fannie Mae dollar rolls. Sourcetable creates visualizations and reports based on simple conversational requests, helping investors identify profitable transaction opportunities in securities shortage scenarios.

Use Cases for Dollar Roll Analysis with Sourcetable

Real-Time Profitability Analysis |

Use Sourcetable's AI chatbot to analyze dollar roll transaction profitability. Upload market data files or connect to financial databases, then let the AI perform complex calculations and create visualizations to identify profitable opportunities. |

Automated Hedge Date Extension |

Input roll market data into Sourcetable and ask the AI to analyze hedge extension opportunities. The AI assistant can create charts and calculations to identify optimal timing for hedge date extensions with minimal duration risk. |

Liquidity Management Dashboard |

Tell Sourcetable's AI to create dynamic dashboards that track short-term liquidity from dollar roll transactions. The AI can generate visualizations and automatically update calculations as you upload new position data. |

Multi-Dataset Transaction Analysis |

Upload multiple data files or connect your database containing dollar roll agreements. Let Sourcetable's AI analyze transaction patterns and generate insights through natural language conversation, without needing to write complex formulas. |

Frequently Asked Questions

What is Dollar Roll Analysis?

Dollar Roll Analysis is the evaluation of a reverse repurchase agreement where securities are bought and sold at a higher price in the future on a specific date. It provides short-term liquidity and cash to the initiators.

How do you execute a Dollar Roll transaction?

To execute a Dollar Roll transaction, buy a TBA contract for the front month and sell a TBA contract for the back month. You can use the same CUSIP for both contracts in a TBA dollar roll, though CUSIPs can differ in a standard dollar roll.

How do you analyze the profitability of a Dollar Roll?

To analyze Dollar Roll profitability, calculate the sum of long roll positions and determine the P&L of the long TBA roll using the bid/ask spread and top of book data of the roll. This analysis can be easily performed in Sourcetable by simply describing your analysis to the AI chatbot, which will help you calculate the necessary metrics and create visualizations of your results.

Conclusion

Dollar roll analysis in mortgage-backed securities (MBS) markets requires precise calculations for the WAM adjustments based on factor dates - reducing by 1 month for 10/19 and 2 months for 11/19 when calculating the dollar advantage on $100 million of MBS. While Excel templates and formulas can handle these calculations, modern AI alternatives like Sourcetable eliminate the complexity.

Sourcetable reimagines spreadsheet analysis through AI-powered conversation. Instead of wrestling with Excel formulas, simply tell Sourcetable's AI chatbot what analysis you need. Upload your MBS data and let the AI handle the calculations, generate visualizations, and deliver insights - no spreadsheet skills required. Start your AI-powered dollar roll analysis at https://app.sourcetable.cloud/signup.