Introduction

Drawdown Analysis measures how much an investment or well's value declines from its peak. For oil and gas wells, this analysis uses flowing bottom hole pressure data to determine well performance and reservoir characteristics. Traditional analysis requires complex Excel formulas and manual data manipulation.

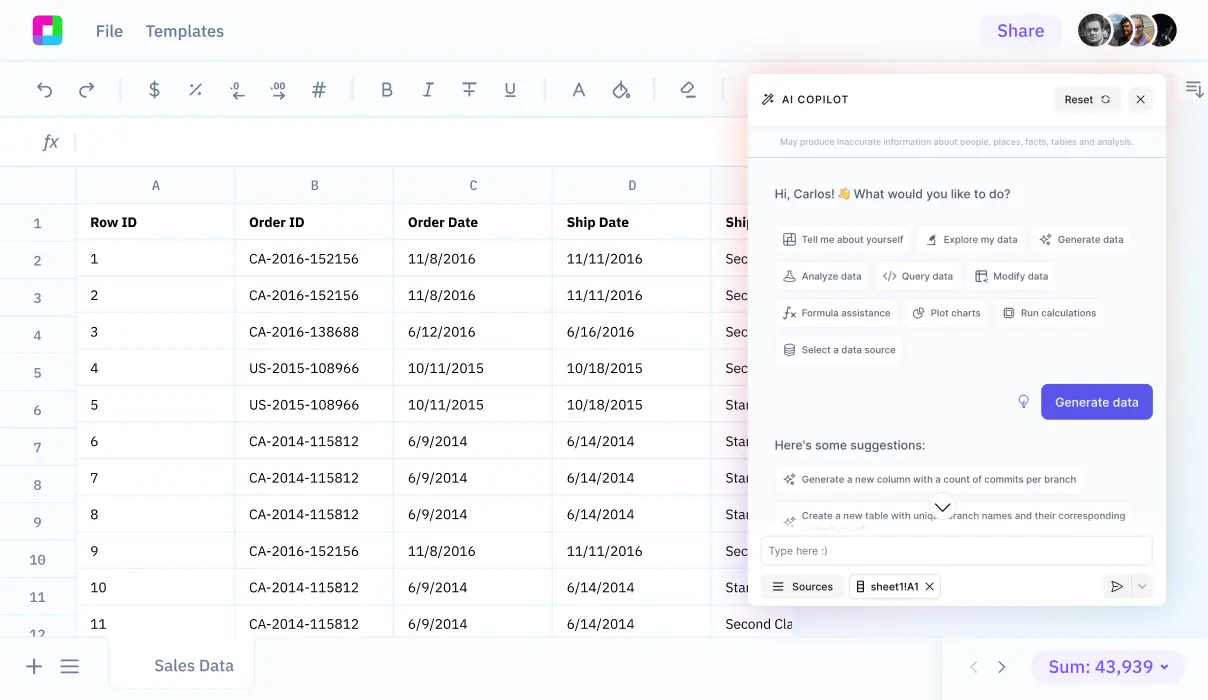

Sourcetable, an AI-powered spreadsheet platform, transforms this analysis process. Instead of complex Excel formulas, Sourcetable's AI chatbot creates spreadsheets, generates data, and produces visualizations through natural conversation. Simply upload your data file or connect your database, tell the AI what analysis you need, and Sourcetable handles the technical work automatically.

Learn how to perform automated Drawdown Analysis with Sourcetable's AI features at https://app.sourcetable.cloud/signup.

Why Sourcetable Is Superior for Drawdown Analysis

Sourcetable transforms drawdown analysis through its AI-powered chatbot interface. Unlike Excel, which requires manual formulas and complex functions, Sourcetable lets you analyze drawdowns through simple conversational commands, making financial analysis accessible and efficient.

Advanced Visualization Capabilities

Simply tell Sourcetable's AI what visualizations you need, and it automatically creates stunning charts and graphics for drawdown analysis. This natural language approach eliminates the steep learning curve associated with Excel's visualization tools.

AI-Powered Efficiency

While 67.4% of managers still rely on traditional spreadsheets, Sourcetable's AI chatbot interface offers a more intuitive approach. Upload your financial data or connect your database, then let the AI handle complex drawdown calculations and analysis automatically.

Real-Time Analysis and Automation

Sourcetable processes financial data hundreds of thousands of times faster than traditional Excel analysis. Its conversational AI interface enables instant drawdown calculations, automated chart generation, and comprehensive analysis - all through simple text commands rather than complex Excel functions.

By transforming complex drawdown analysis into a conversational experience, Sourcetable represents the future of financial data analysis. Its AI chatbot interface eliminates the need to learn complex spreadsheet functions, making sophisticated financial analysis accessible to everyone.

Benefits of Drawdown Analysis with Sourcetable vs Excel

Why Drawdown Analysis Matters

Drawdown analysis helps investors assess investment risk by measuring declines from previous peaks. This analysis evaluates both monetary losses and recovery time, enabling investors to choose investments that recover more quickly from market downturns. Understanding drawdown patterns helps maintain portfolio resilience and supports informed investment decisions.

Essential Drawdown Metrics

Key metrics for effective drawdown analysis include the Maximum Drawdown, Calmar Ratio, Sterling Ratio, Ulcer Index, and Pain Index. The Calmar Ratio compares annual returns to maximum drawdown, while the Drawdown Quotient evaluates how maximum drawdowns deviate from average drawdowns. These metrics provide crucial insights into portfolio risk and performance.

Advantages of Sourcetable for Drawdown Analysis

Sourcetable's AI-powered platform revolutionizes drawdown analysis through natural language interaction. Unlike Excel's complex functions, Sourcetable lets you simply tell its AI chatbot what analysis you need. Upload your data files or connect your database, and the AI automatically performs calculations, creates visualizations, and generates insights. This intuitive approach eliminates the learning curve associated with traditional spreadsheet functions.

Enhanced Analysis Capabilities

While Excel requires manual configuration of formulas and charts, Sourcetable's AI instantly transforms your requests into sophisticated analyses. The platform can create complex visualizations, generate sample data, and perform in-depth drawdown calculations through simple conversational commands. This AI-driven approach ensures faster, more accurate portfolio risk assessment while eliminating the tedium of traditional spreadsheet work.

Types of Drawdown Analysis in Sourcetable

Drawdown analysis measures peak-to-trough declines in financial equity over time, typically expressed as percentages. While traditionally performed in Excel using complex formulas, Sourcetable's AI chatbot simplifies the process through natural language commands.

Financial Performance Analysis

Key drawdown metrics include the Ulcer Index (UI) for tracking drawdowns and Sterling ratios for comparing risk-adjusted returns. Through simple conversational prompts to Sourcetable's AI, you can analyze Maximum drawdown (MDD) across different investments and generate visual comparisons.

Data-Driven Analysis

Upload your financial data files or connect your database to Sourcetable for comprehensive drawdown analysis. The AI chatbot helps you interpret results, create visualizations, and generate sample data for testing different scenarios.

Technical Analysis

For specialized applications like well pumping tests, simply tell Sourcetable's AI what you want to analyze. The platform can compute transmissivity and storativity from observation well data using least squares fitting between observed and predicted drawdowns in isotropic homogeneous nonleaky aquifers.

Sourcetable Drawdown Analysis Use Cases

Real-Time Stock Performance Analysis |

Use Sourcetable's AI chatbot to automatically analyze stock drawdowns from uploaded trading data. Simply ask the AI to calculate drawdown percentages using |

Historical Drawdown Pattern Recognition |

Upload historical stock data to Sourcetable and ask its AI to analyze how many times a stock experiences specific drawdown percentages. The AI will apply |

Annual Drawdown Frequency Assessment |

Connect your financial database to Sourcetable and ask its AI to calculate average annual drawdown occurrences. The AI will automatically determine how often stocks experience specific drawdown percentages each year. |

Portfolio Risk Analysis |

Let Sourcetable's AI analyze your portfolio data to identify drawdown patterns and potential risks. Simply describe your analysis needs to the AI chatbot, and it will generate comprehensive drawdown visualizations and insights. |

Frequently Asked Questions

What is Drawdown Analysis and why is it important?

Drawdown Analysis is an investment term that measures the decline in value from a peak to a trough for a single investment or portfolio. It is an important risk factor for investors that considers two key elements: the monetary amount of the decline and the time duration of the decline. This type of analysis is becoming increasingly important in asset management.

What types of analysis can be performed with Drawdown Analysis?

Drawdown Analysis can be used to evaluate investment performance through maximum drawdown calculations, estimate the impact of pumping on groundwater levels, determine timing and magnitude of drawdown effects, and analyze multiple well fields using time series models. The analysis can be performed using data-driven approaches with physically-based response functions.

How can Sourcetable help perform Drawdown Analysis?

Sourcetable is an AI-powered spreadsheet that makes Drawdown Analysis simple through natural language interaction. After uploading your data file or connecting your database, you can simply tell Sourcetable's AI chatbot what analysis you want to perform, and it will automatically analyze your data and create stunning visualizations and charts. This eliminates the need for complex formulas or manual calculations typically required in traditional spreadsheet software.

Conclusion

Drawdown analysis helps investors measure and manage portfolio risk by calculating peak-to-valley declines. While Excel can perform basic drawdown calculations using functions like MAX and statistical formulas, it requires manual data entry and formula creation. Modern drawdown analysis demands real-time monitoring and automated calculations.

For a more sophisticated approach, Sourcetable offers an AI alternative that eliminates the need to learn complex Excel functions. Simply upload your data and tell Sourcetable's AI chatbot what analysis you need. The AI can automatically generate drawdown calculations, create visualizations, and analyze large datasets that would typically slow down Excel.

Key advantages of using Sourcetable for drawdown analysis include natural language interactions with your data, instant chart creation, and AI-powered insights. Instead of manually creating formulas and charts, you can simply describe what you want to analyze, and Sourcetable's AI will handle the technical details for you.