Introduction

Equity analysis is a critical process for determining a company's value through examination of financial statements, market conditions, and future projections. Traditionally, analysts have used Excel spreadsheets to input financial statements, calculate key ratios, and value companies using Discounted Cash Flow (DCF) models. While Excel remains powerful for calculating book value, market value, and enterprise value, modern AI alternatives are revolutionizing the analysis process.

AI tools enhance both the efficiency and effectiveness of equity analysis, saving analysts dozens of hours per company while enabling broader market coverage. These tools excel at generating investment ideas, initiating new company coverage, and maintaining existing coverage through automated news and filing monitoring.

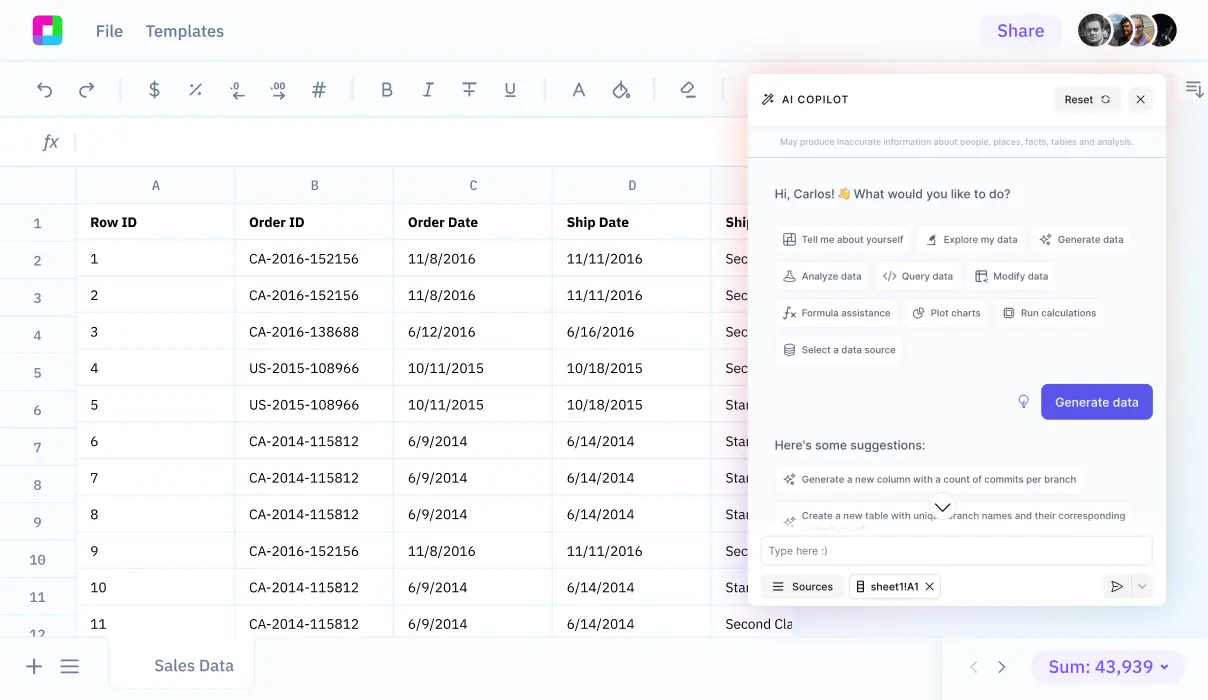

Sourcetable emerges as a breakthrough solution, offering an AI-powered spreadsheet platform that eliminates the need for complex Excel functions. Through natural language interaction with an AI chatbot, analysts can create spreadsheets, analyze financial data, and generate visualizations effortlessly. Simply upload your financial data or connect your database, and let Sourcetable's AI transform your equity analysis workflow. Experience how Sourcetable transforms equity analysis by signing up at https://app.sourcetable.cloud/signup.

Why Sourcetable Revolutionizes Equity Analysis

Sourcetable transforms equity analysis by replacing Excel's complex functions with an AI-powered conversational interface. Instead of learning formulas and features, analysts can simply tell Sourcetable what they want to analyze, and the AI automatically performs the analysis, creates visualizations, and generates insights.

Enhanced Efficiency and Automation

While Excel requires manual formula creation and data manipulation, Sourcetable's AI chatbot automates the entire analysis process. Simply upload your financial data or connect your database, then use natural language to request any analysis - from basic calculations to complex equity valuations.

AI-Powered Insights

Sourcetable's AI capabilities extend beyond basic calculations, enabling analysts to uncover insights through natural conversation. Ask questions about your data, generate sample datasets, create custom visualizations, and analyze market trends - all through simple chat interactions rather than complex Excel workflows.

Democratized Data Access

Unlike Excel's steep learning curve, Sourcetable enables anyone to perform sophisticated equity analysis through natural language commands. The AI interface eliminates technical barriers, allowing team members to focus on interpreting insights rather than managing spreadsheet mechanics.

Benefits of Equity Analysis with Sourcetable vs Excel

Why Equity Analysis Matters

Equity financing provides companies with capital without repayment obligations or additional financial burden. Companies gain access to experienced investors who bring expertise and connections. This financing method improves company health by reducing debt-to-equity ratios and enhancing credit scores.

Sourcetable's AI-Powered Advantage

Sourcetable revolutionizes spreadsheet work through its AI chatbot interface. Instead of manually working with complex Excel functions, users can simply tell Sourcetable what they want to analyze. The AI understands natural language commands to create spreadsheets, analyze data, and generate stunning visualizations instantly.

Enhanced Financial Analysis Tools

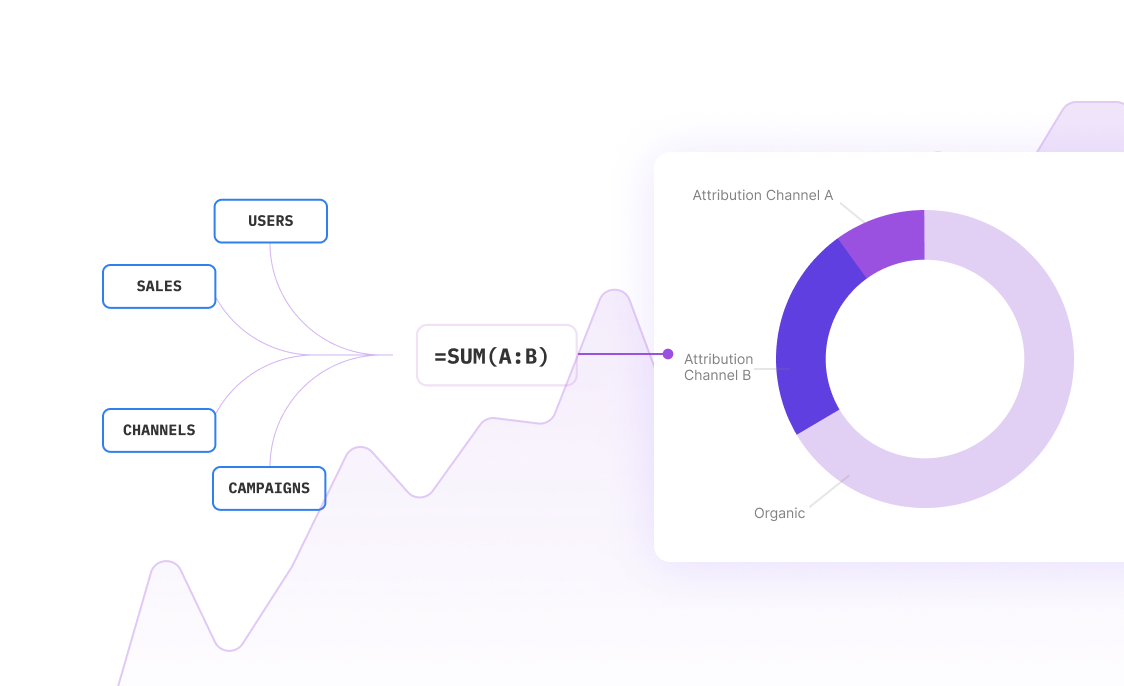

Sourcetable simplifies financial analysis through conversational AI. Upload any size data file or connect your database, then let the AI analyze stock prices, trading volumes, and market indices. The platform's natural language interface helps analysts optimize asset allocation and create comprehensive financial models without spreadsheet expertise.

Excel Alternative with Superior Features

Unlike Excel's complex function-based approach, Sourcetable transforms spreadsheet work through AI-powered conversation. Simply describe your analysis needs, and Sourcetable creates dynamic reports, visualizations, and automated workflows. This natural language approach makes financial analysis more accessible and efficient than traditional spreadsheet tools.

Equity Analysis Examples Using Sourcetable

Sourcetable is an AI-powered spreadsheet that simplifies equity analysis through natural language interactions. Instead of complex Excel formulas, users can chat with an AI assistant to analyze financial data, create visualizations, and generate insights.

Fundamental Analysis Examples

Analyze equity ratios by simply telling Sourcetable's AI what you want to calculate. Upload your financial data or connect your database, and the AI assistant will handle calculations like Shareholders' Equity / (Total Assets - Intangible Assets) automatically.

Data-Driven Valuation

Perform Comparable Company Analysis (CCA) by instructing Sourcetable's AI to analyze similar companies. The AI assistant processes financial data, generates relevant comparisons, and complements traditional DCF analysis with market-based valuations.

Advanced Analytics Features

Create sophisticated equity analyses without writing complex formulas. Sourcetable's AI interprets your requests in natural language, automatically generating the necessary calculations, charts, and insights from your uploaded data.

Automated Trend Analysis

Let Sourcetable's AI identify market trends and patterns in your historical data. Simply describe the analysis you need, and the AI assistant will process your data, generate visualizations, and provide insights for portfolio decisions.

Use Cases for Sourcetable in Equity Analysis

Growth Equity Case Studies |

Use AI-powered conversations to analyze customer-level revenue, including renewal rates, upgrades, and downgrades. Generate investment recommendations and financial projections by describing your analysis needs to Sourcetable's chatbot. |

Financial Data Processing |

Upload large CSV files or connect databases containing financial data. Let Sourcetable's AI assistant analyze and transform complex datasets through natural language commands. |

Dynamic Visualization Creation |

Generate compelling financial charts and visualizations by describing what you want to see. Sourcetable's AI converts your requests into professional-grade graphics for equity analysis presentations. |

Automated Financial Analysis |

Perform complex equity analyses by conversing with Sourcetable's AI. Skip manual Excel formulas and let the AI chatbot handle data processing, statistical calculations, and financial modeling tasks. |

Frequently Asked Questions

What is equity analysis and why is it important?

Equity analysis is a comprehensive approach to evaluating stocks using fundamental, technical, and quantitative analysis methods. It helps investors understand investment opportunities, industry competition, and market trends. Fundamental analysis is best for long-term investments, while technical analysis suits short-term decisions.

How does Sourcetable's AI capabilities enhance equity analysis?

Sourcetable is an AI-powered spreadsheet that simplifies equity analysis by letting you interact with a chatbot to analyze data, create visualizations, and generate reports. Instead of dealing with complex Excel functions, you can simply tell Sourcetable what analysis you want to perform, and its AI will handle the technical work for you.

How can I get started with equity analysis in Sourcetable?

You can begin by uploading your financial data files (CSV, XLSX, etc.) or connecting your database to Sourcetable. Then, simply tell the AI chatbot what kind of analysis you want to perform, and it will help you analyze the data and create stunning visualizations and charts. The AI handles the complex calculations and formulas, making equity analysis more accessible and efficient.

Conclusion

Traditional equity analysis in Excel requires manual calculations using the DCF method to find enterprise value (NPV of FCFF), then adding cash and subtracting debt to determine equity value. While Excel offers robust features for smaller datasets and routine calculations, it struggles with big data and complex pattern recognition.

AI-powered alternatives like Sourcetable eliminate the need for complex Excel functions and manual calculations. Simply upload your data files or connect your database, then tell Sourcetable's AI chatbot what analysis you need. This conversational approach enables faster analysis, automated pattern recognition, and reduced human error—all without requiring Excel expertise.

For modern equity analysis, Sourcetable offers a compelling solution that makes sophisticated financial modeling accessible to everyone. Experience how Sourcetable simplifies equity analysis by signing up at https://app.sourcetable.cloud/signup.