Introduction

Real estate financial analysis helps investors make informed decisions about property investments through careful evaluation of metrics and market data. Traditional analysis often relies on Excel's powerful functions like NPV, IRR, and PMT to calculate valuations, returns, and loan payments. While Excel remains a valuable tool, AI-powered alternatives now offer enhanced capabilities for faster, more precise investment decisions.

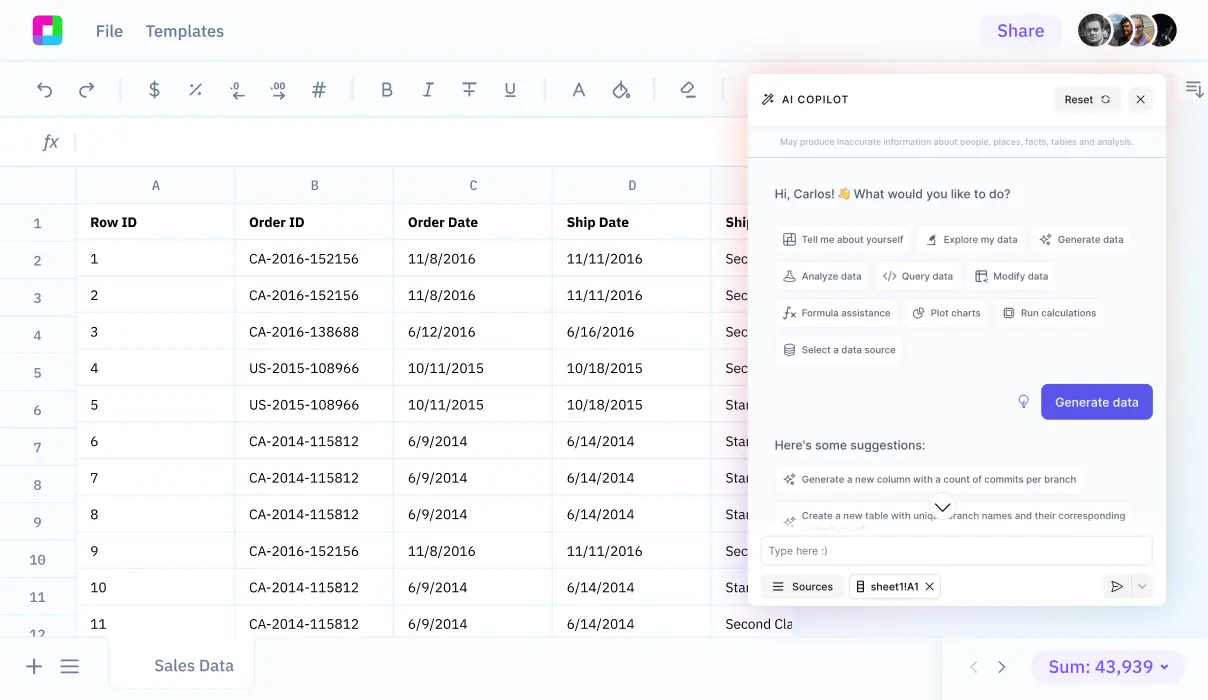

Sourcetable reimagines spreadsheet analysis through conversational AI. Rather than navigating complex Excel functions, users simply tell Sourcetable's AI chatbot what they want to analyze. The platform can process any uploaded real estate data files or connect directly to databases, making comprehensive financial analysis accessible to everyone. This AI-powered approach streamlines the evaluation of crucial metrics like occupancy rates, rental income, and investment returns.

In this guide, we'll explore how Sourcetable transforms real estate financial analysis through natural conversation with AI - no Excel expertise required.

Why Sourcetable Is Superior for Real Estate Financial Analysis

Sourcetable transforms real estate financial analysis by replacing Excel's complex functions with an intuitive AI chatbot interface. While Excel requires manual function input and formatting, Sourcetable lets you analyze data through natural conversation, making spreadsheet analysis accessible and efficient.

Advanced Analysis Capabilities

Sourcetable's AI chatbot instantly analyzes uploaded real estate data or connected databases. Simply describe your analysis goals, and Sourcetable performs calculations, generates insights, and creates sample data sets - all without requiring spreadsheet expertise or formula knowledge.

AI-Powered Efficiency

Natural language processing enables you to create spreadsheets, analyze data, and generate reports through simple conversation. This AI-first approach streamlines analysis tasks that would require manual formula creation and data manipulation in Excel.

Enhanced Visualization and Reporting

Sourcetable creates stunning data visualizations and comprehensive reports through natural language commands. This conversational approach to data visualization surpasses Excel's complex charting tools, enabling better presentations and more insightful analysis with minimal effort.

Real Estate Financial Analysis Benefits & Tools

Why Real Estate Financial Analysis Matters

Real estate financial analysis equips investors and brokers with essential tools to evaluate property investments. This analytical approach helps understand cash flows, tax implications, and various investment strategies. By analyzing metrics like cash on cash return and capitalization rate, investors can compare properties and assess investment risks.

Advantages of Using Sourcetable for Real Estate Analysis

Sourcetable, an AI-powered spreadsheet platform, revolutionizes real estate analysis through natural language interaction. Instead of navigating complex Excel functions, users can simply tell Sourcetable what they want to analyze. The platform's AI chatbot handles everything from data analysis to creating stunning visualizations, making property investment analysis more accessible and efficient.

Streamlined Analysis Process

Sourcetable simplifies real estate analysis by accepting file uploads of any size or direct database connections. The AI-powered platform automatically processes data, identifies trends, and generates insights based on natural language requests. This approach eliminates the need for manual spreadsheet manipulation while delivering professional-quality analysis and visualizations.

Financial Reporting and Documentation

Sourcetable's AI capabilities extend to creating comprehensive financial reports and visualizations. The platform transforms complex real estate data into clear, actionable insights, helping investors make informed decisions about property investments through intuitive conversation with its AI chatbot.

Real Estate Financial Analysis Examples Using Sourcetable

Sourcetable's AI chatbot interface revolutionizes real estate financial analysis by eliminating complex Excel functions. Users simply tell the AI what analysis they need, and Sourcetable creates and processes spreadsheets automatically.

Fundamental and Technical Analysis

Upload your property data files or connect your database, and Sourcetable's AI will analyze key metrics like occupancy rates, rental income, and cost per square foot. The AI assistant can create charts and visualizations to demonstrate market trends.

Vertical and Horizontal Analysis

Through natural language commands, Sourcetable generates property value calculations and sensitivity analyses. The AI can create tables showing relationships between property values per square foot and performance metrics from your uploaded data.

Investment Decision Analysis

Instead of manual financial modeling, simply ask Sourcetable's AI to analyze transaction assumptions, construction periods, and operating projections. The platform helps evaluate property investment decisions through conversation-driven analysis.

Predictive Analytics

Sourcetable's AI processes your uploaded datasets to generate insights about tenant satisfaction and profitability potential. The conversational interface makes complex analysis accessible without advanced spreadsheet knowledge.

Real Estate Financial Analysis Use Cases with Sourcetable

Automated Rental Property Analysis |

Upload rental property data files and use Sourcetable's AI chatbot to instantly analyze cash flow and ROI. Simply ask the AI to calculate key metrics like |

Portfolio Risk Assessment |

Import portfolio data through database connections or file uploads. Tell Sourcetable's AI what risks you want to analyze, and it will create comprehensive risk assessments and automated reports for stakeholders. |

Lease Analysis and Tenant Management |

Upload lease documents and tenant data for AI-powered analysis. Ask Sourcetable to summarize lease terms, identify patterns in tenant behavior, and recommend retention strategies based on historical data. |

Investment Decision Support |

Input investment data through file uploads or database connections. Let Sourcetable's AI analyze market trends, compare property valuations, and generate visualizations to support investment decisions with natural language queries. |

Frequently Asked Questions

What is Real Estate Financial Analysis and what are its key benefits?

Real Estate Financial Analysis is a method to evaluate property investments by calculating metrics like net operating income (NOI), capitalization rates, and cash on cash returns. Its key benefits include helping investors understand property cash flows, compare different properties, analyze tax implications, and make informed investment decisions through portfolio diversification.

What are the main steps in performing Real Estate Financial Analysis?

The main steps are: 1) Set up transaction assumptions, 2) Project the construction period, 3) Build operating assumptions, 4) Build the pro-forma, 5) Make returns calculations, and 6) Make an investment decision. The process begins with calculating NOI by determining gross revenue and total expenses, where gross revenue is calculated from unit size, units, and gross rents, while expenses include property tax, insurance, and maintenance costs.

How can Sourcetable enhance Real Estate Financial Analysis?

Sourcetable, as an AI-powered spreadsheet, simplifies Real Estate Financial Analysis by letting you interact with an AI chatbot to create spreadsheets, analyze data, and generate visualizations. After uploading your real estate data files or connecting your database, you can simply tell the AI chatbot what analysis you need, and it will handle the complex calculations, trend analysis, and report creation. This conversational approach eliminates the need for manual Excel functions and makes financial analysis more accessible and efficient.

Conclusion

Real estate financial analysis traditionally requires extensive Excel knowledge to build complex models with functions like NPV, IRR, and PMT. While Excel libraries like A.CRE offer helpful templates, they require verification and Excel expertise to use effectively.

Sourcetable offers a revolutionary AI-powered alternative that replaces complex Excel functions with natural conversation. Simply tell Sourcetable's AI chatbot what analysis you need, and it will create financial models, generate visualizations, and analyze your data. Upload your real estate data files or connect your database, and let the AI handle the complexity while you focus on making informed investment decisions.

Start analyzing your real estate investments more efficiently - try Sourcetable today.