Introduction

Value at Risk (VaR) analysis helps investors and risk managers quantify potential losses in their portfolios. Three primary methods calculate VaR: historical, variance-covariance, and Monte Carlo simulation. Excel users can perform VaR analysis by calculating mean returns, standard deviations, and confidence intervals using historical data. While Excel provides these basic VaR capabilities, its computational limitations and complex formulas can make analysis tedious and time-consuming.

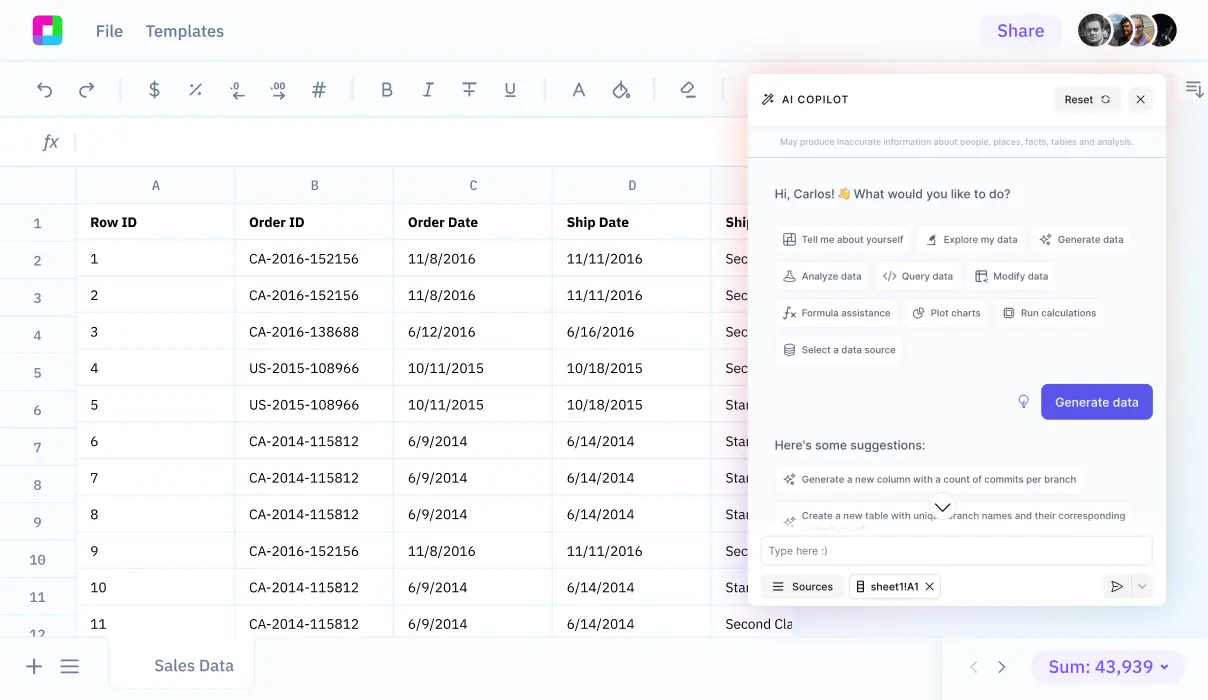

Sourcetable, an AI spreadsheet combining the power of Excel and ChatGPT, offers a simpler approach to VaR analysis. Instead of wrestling with complex formulas and functions, users simply tell Sourcetable's AI chatbot what analysis they need. The AI can handle files of any size, generate sample data, create visualizations, and perform complex calculations without requiring any Excel expertise.

This guide explores how to perform Value at Risk Analysis using Sourcetable's conversational AI interface, which you can try at https://app.sourcetable.cloud/signup.

Why Sourcetable Is Superior for Value at Risk Analysis

Sourcetable transforms Value at Risk (VaR) analysis through its conversational AI interface. While Excel requires manual setup and complex functions, Sourcetable enables you to perform VaR calculations simply by describing what you want to analyze. Upload your financial data or connect your database, and let AI handle the rest.

Enhanced Data Analysis

Sourcetable's AI chatbot eliminates the need to learn Excel formulas or VaR calculation methods. Instead of manually implementing historical or variance-covariance approaches, simply tell Sourcetable what insights you need. The AI understands natural language commands and performs complex risk calculations automatically.

Streamlined Workflow

Excel VaR analysis requires multiple manual steps and precise function setup. Sourcetable's AI chatbot automates the entire process, from data preparation to final analysis. Tell the AI what assets you want to analyze, and it will perform the calculations across shares, bonds, derivatives, and currencies.

Advanced Visualization

While Excel requires manual chart creation, Sourcetable generates sophisticated risk visualizations through simple conversation. Ask the AI to create heatmaps, risk matrices, or any other visualization, and it will instantly produce publication-ready charts that clearly communicate your VaR findings.

Sourcetable revolutionizes VaR analysis by replacing Excel's complex functions with an intuitive AI chatbot interface, making advanced risk analysis accessible to everyone.

Benefits of Value at Risk (VaR) Analysis with Sourcetable

Value at Risk Analysis Benefits

Value at Risk (VaR) is a powerful statistical measure that quantifies potential financial losses for firms and investments. VaR provides a single, easily interpreted number expressed in percentage or price units. Financial professionals widely use VaR across different asset types, including shares, bonds, derivatives, and currencies.

VaR modeling helps financial institutions determine capital reserve requirements and assess portfolio risk. Three calculation methods - historical analysis, variance-covariance, and Monte Carlo simulation - enable precise risk assessment. Many financial software platforms, including Bloomberg terminals, include built-in VaR calculations.

Advantages of Using Sourcetable for VaR Analysis

Sourcetable's AI chatbot interface revolutionizes VaR analysis by eliminating complex spreadsheet functions and formulas. Simply upload your financial data files or connect your database, then tell the AI what analysis you need. The platform handles complex calculations automatically, making VaR analysis accessible and efficient.

Unlike traditional Excel-based analysis, Sourcetable's conversational AI approach simplifies data analysis and visualization. The platform generates stunning charts and visualizations of your VaR calculations through simple natural language requests. This AI-driven approach accelerates analysis while maintaining accuracy, enabling faster and more informed risk assessment decisions.

Value at Risk Analysis Examples in Sourcetable

Value at Risk (VaR) analysis in Sourcetable is simplified through its AI-powered interface. Simply upload your financial data or connect your database, then ask the AI to perform VaR calculations. For instance, you can request analysis showing a 3% one-month VaR of 2%, indicating a 3% probability of an asset's value declining by 2% within one month.

Monte Carlo Simulation

Request Sourcetable's AI to run thousands of market scenarios for calculating VaR and Conditional VaR (CVaR). Simply tell the AI what scenarios you want to simulate, and it will handle the computational modeling for projected returns.

Historical Method

Ask Sourcetable's AI to analyze historical returns for future predictions. The AI will automatically process your uploaded data or database information to help financial institutions determine capital reserve requirements.

Variance-Covariance Method

Tell Sourcetable's AI to perform variance-covariance analysis, and it will calculate risk measurements assuming normal distribution of gains and losses. Share results instantly with your team through Sourcetable's collaborative platform.

Value At Risk Analysis Use Cases with Sourcetable

Portfolio Risk Assessment |

Investment banks can analyze portfolio data by uploading files or connecting databases to Sourcetable's AI chatbot. Simply describe the risk analysis needed, and the AI generates accurate VAR calculations and continuous risk monitoring models without complex formula building. |

Regulatory Capital Requirements |

Banks can calculate regulatory capital requirements by conversing with Sourcetable's AI. Upload compliance data and ask the AI to generate required calculations and reports, eliminating the need for manual spreadsheet formulas. |

Risk Limit Monitoring |

Risk managers can monitor trading activity by telling Sourcetable's AI what patterns to watch for. The AI analyzes uploaded trading data to detect limit breaches and create risk oversight reports through natural conversation. |

Stress Testing and Model Validation |

Financial institutions can perform stress testing by describing scenarios to Sourcetable's AI. The AI automatically creates visualizations, runs simulations, and validates models based on uploaded historical data, without requiring manual spreadsheet configuration. |

Frequently Asked Questions

What is Value at Risk Analysis and why is it important?

Value at Risk (VaR) is a statistical measure that quantifies potential financial losses and their probabilities. It is crucial for risk managers, investment banks, and commercial banks to measure and control risk exposure across specific positions or entire portfolios. VaR is widely used for risk reporting, regulatory capital requirements, economic capital calculations, and portfolio optimization.

How can I perform Value at Risk Analysis in Sourcetable?

With Sourcetable's AI-powered interface, you can easily perform VaR analysis by uploading your financial data files or connecting your database, then simply telling the AI chatbot what analysis you need. Sourcetable supports all three main VaR methods: Historical, Variance-covariance, and Monte Carlo simulation, and can automatically generate the calculations and visualizations you need through natural language commands.

How does AI enhance Value at Risk Analysis in Sourcetable?

AI integration in VaR Analysis through Sourcetable improves forecasting accuracy, optimizes variable selection, and enables robust data-driven risk models for stress testing. Instead of manual calculations and complex formulas, you can simply tell Sourcetable's AI what analysis you need, and it will automatically generate accurate results, beautiful visualizations, and comprehensive reports.

How can Value at Risk Analysis results be used to make financial decisions?

VaR modeling results help financial institutions determine if their capital reserves are sufficient to cover potential losses and if they need to reduce concentrated holdings based on risk levels. Through Sourcetable's AI capabilities, you can easily analyze this data and create stunning visualizations and reports to support risk budgeting, asset allocation, hedge optimization, and tracking error optimization decisions.

Conclusion

Value at Risk (VaR) analysis remains a crucial tool for risk assessment in finance. While Excel provides the ability to calculate VaR using historical methods, variance-covariance methods, and Monte Carlo simulations, these calculations can be time-consuming and require advanced Excel skills. The historical method, though simplest to implement in Excel through mean returns and standard deviation calculations, only offers a basic risk perspective.

Modern AI alternatives like Sourcetable eliminate the complexity of VaR analysis through natural language interaction. Instead of wrestling with Excel formulas and functions, simply upload your data and tell Sourcetable's AI chatbot what analysis you need. Sourcetable processes complex VaR calculations instantly and creates stunning visualizations of your risk analysis - no spreadsheet expertise required.

Ready to modernize your Value at Risk analysis? Try Sourcetable's AI-powered platform at https://app.sourcetable.cloud/signup and experience how conversational AI simplifies complex financial calculations.