Introduction

Capital Asset Pricing Model (CAPM) analysis helps investors calculate expected returns based on systematic risk. Traditional CAPM analysis in Excel requires setting risk-free rates and market returns as assumptions, inputting asset betas, and using formulas like =$C$3+(C9*($C$4-$C$3)) to calculate expected returns. While Excel handles the linear calculations required for CAPM, it can be time-consuming to set up and maintain the models.

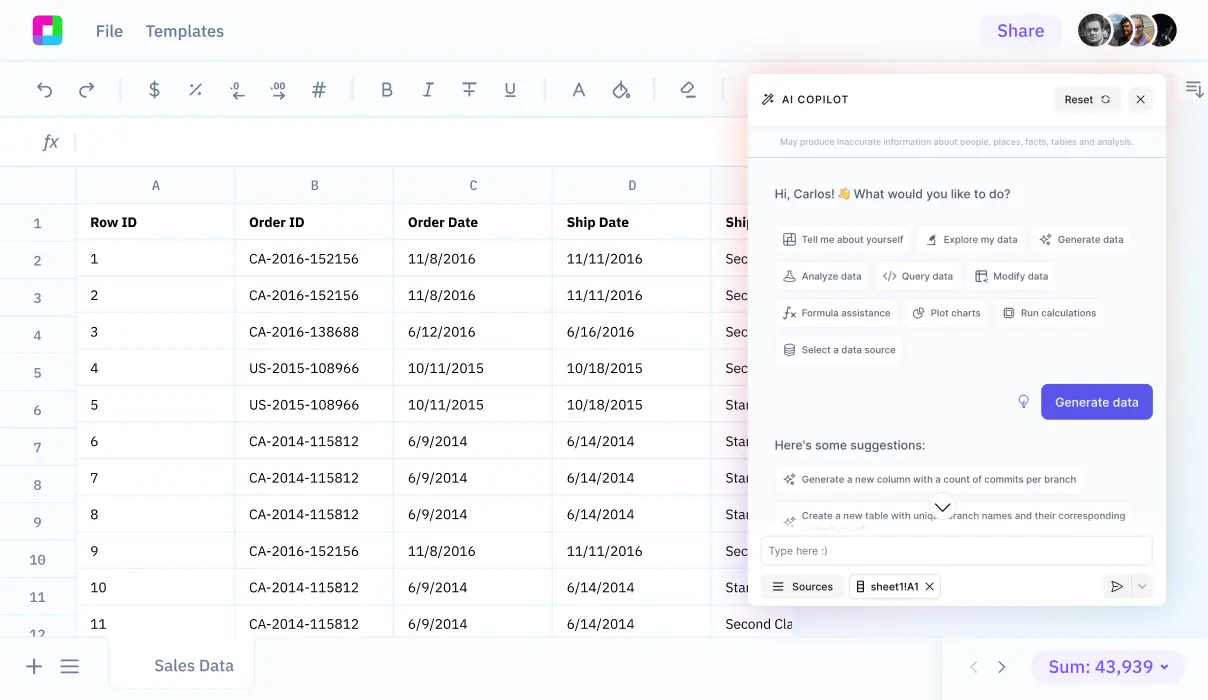

Sourcetable, an AI-powered spreadsheet platform, transforms how analysts perform CAPM analysis. Instead of wrestling with complex Excel formulas and functions, users simply tell Sourcetable's AI chatbot what analysis they need. The AI assistant handles everything from data processing to visualization, making financial modeling accessible regardless of technical expertise. Upload your financial data or connect your database, and let Sourcetable's AI generate insights and create stunning visualizations.

Learn how to perform automated CAPM analysis with Sourcetable's AI features at https://app.sourcetable.cloud/signup.

Why Sourcetable Is the Best Platform for CAPM Analysis

While Excel remains a common tool for financial analysis, Sourcetable revolutionizes CAPM analysis through its AI-powered chatbot interface. By replacing complex Excel functions with natural language interaction, Sourcetable simplifies the entire CAPM workflow while maintaining analytical power.

Conversational Analysis

Instead of wrestling with Excel formulas, Sourcetable lets you perform CAPM analysis through simple conversation with its AI assistant. Upload your financial data or connect your database, then tell Sourcetable what insights you need. The platform handles the complex calculations automatically.

Natural Language Processing

Sourcetable's AI chatbot enables users to perform exploratory analysis on stock returns through simple commands. This capability makes CAPM analysis more accessible while maintaining the model's advantages of simplicity and stress-testing capabilities.

Enhanced Data Visualization

Through simple conversation, Sourcetable transforms complex CAPM data into clear visualizations, helping stakeholders understand risk-reward relationships and identify optimization opportunities. These visual insights support better financial decision-making and pattern recognition in systematic risk assessment.

Advanced Forecasting

The platform's AI capabilities improve forecasting accuracy and automate scenario analysis, providing more reliable CAPM outcomes than traditional Excel-based approaches. Simply describe the analysis you need, and Sourcetable's AI will generate comprehensive financial insights.

CAPM Analysis Benefits and Why Sourcetable Is Better Than Excel

Benefits of CAPM Analysis

CAPM provides a straightforward method to calculate expected returns while accounting for systematic risk. Its widespread adoption and simple calculation make it a valuable tool for investment analysis. CAPM integrates with other metrics like the Sharpe Ratio for comprehensive risk-reward assessment and can evaluate multiple assets using an efficient frontier.

Why Choose Sourcetable for CAPM Analysis

Sourcetable's AI-powered platform transforms CAPM analysis through natural language interaction. Unlike Excel's complex functions, Sourcetable lets you simply describe your analysis needs to its AI chatbot, which then handles all calculations and visualizations. It supports files of any size and database connections for seamless data analysis.

Enhanced Financial Analysis Capabilities

Beyond CAPM, Sourcetable's AI chatbot can perform comprehensive financial analysis simply through conversation. Tell it what metrics you need - from capital efficiency to liquidity ratios - and it will analyze your data and create stunning visualizations. This conversational approach eliminates the need for complex formulas and manual spreadsheet manipulation, making financial analysis faster and more intuitive.

Types of CAPM Analysis with Sourcetable

Sourcetable's AI chatbot enables CAPM analysis through natural language commands, eliminating the need for complex spreadsheet formulas. Users can perform various analyses including CAPM and Beta, CAPM and the Efficient Frontier, CAPM and the SML, and CAPM and portfolio optimization by simply describing their analytical needs.

Example CAPM Calculations

The AI chatbot can generate CAPM calculations for cost of equity (ke) from uploaded data or connected databases. A typical calculation shows Ke = 3% + 0.8(7.0%) = 8.6%. Another example demonstrates Ke = 2.5% + (0.5 5.5%) = 5.3%. Multiple companies can be analyzed simultaneously, as shown by Company A at 5.3%, Company B at 8.0%, and Company C at 10.8%.

Advanced Analysis Features

Sourcetable's AI chatbot processes complex CAPM analyses instantly through natural language requests. Users can upload files of any size or connect databases to perform comprehensive analysis. The platform automatically generates visualizations and charts to illustrate CAPM relationships and portfolio performance metrics.

Formula Management

Instead of manual formula creation, Sourcetable's AI handles all calculations automatically. Users simply describe their analysis needs in plain language, and the AI generates accurate results and visualizations. This approach eliminates formula syntax concerns and streamlines the entire CAPM analysis process.

Use Cases for CAPM Analysis with Sourcetable

Multi-Asset Return Comparison |

Upload multiple asset data files and ask Sourcetable's AI to compare expected returns using CAPM formula |

AI-Enhanced Cost of Equity Estimation |

Tell Sourcetable's AI to analyze historical financial data and generate cost of equity estimations. The AI chatbot handles complex calculations and creates visualizations to present findings clearly. |

Comparative Risk Analysis |

Direct Sourcetable's AI to analyze systematic risk across securities using beta calculations. The AI chatbot combines CAPM with Sharpe Ratio calculations automatically for comprehensive risk-reward assessment. |

Dynamic Market Premium Assessment |

Ask Sourcetable's AI to calculate and visualize equity risk premiums from your uploaded financial data. The AI chatbot handles all calculations and creates dynamic charts to track market premium trends. |

Frequently Asked Questions

What is CAPM Analysis and why is it important?

CAPM (Capital Asset Pricing Model) is a finance model that establishes a linear relationship between required return on investment and risk. It calculates the expected rate of return for assets by using the risk-free rate plus beta multiplied by the equity risk premium. CAPM is widely used throughout finance for pricing risky securities, generating expected returns, and making investment decisions.

What can you do with CAPM Analysis?

CAPM Analysis allows you to evaluate the reasonableness of future expectations, conduct investment comparisons, understand portfolio risk and expected return, and calculate the cost of equity which is a key input for WACC calculations. The model is widely used because it's simple and enables easy comparisons of investment alternatives.

How can you perform CAPM Analysis in Sourcetable?

Sourcetable makes CAPM Analysis simple through its AI-powered interface. After uploading your financial data or connecting your database, you can simply tell Sourcetable's AI chatbot what analysis you want to perform. The AI will help you calculate the CAPM formula (Ke = rf + β(rm – rf)), analyze the results, and create stunning visualizations of your analysis. No need to work with complex formulas or Excel functions - just describe what you want to achieve, and Sourcetable's AI will handle the calculations and presentation for you.

Conclusion

CAPM Analysis can be performed in Excel using the formula Ra = Rrf + Ba(Rm) or the cell-based formula =$C$3+(C9*($C$4-$C$3)). This traditional approach requires knowledge of Excel formulas and cell referencing.

For a simpler approach, Sourcetable offers an AI-powered alternative that eliminates the need for complex formulas. Simply upload your financial data and ask Sourcetable's AI chatbot to perform your CAPM analysis. The AI assistant will analyze your data, generate appropriate visualizations, and provide insights - making CAPM analysis accessible regardless of your spreadsheet expertise.

Ready to streamline your CAPM Analysis? Try Sourcetable today to experience AI-powered financial modeling that turns complex spreadsheet tasks into simple conversations.