Introduction

Portfolio analysis traditionally relies on Excel's powerful functions for calculating returns, statistics, and covariances. While spreadsheets effectively maintain portfolios through asset allocation tracking and return calculations using functions like XIRR, modern AI tools have revolutionized this process.

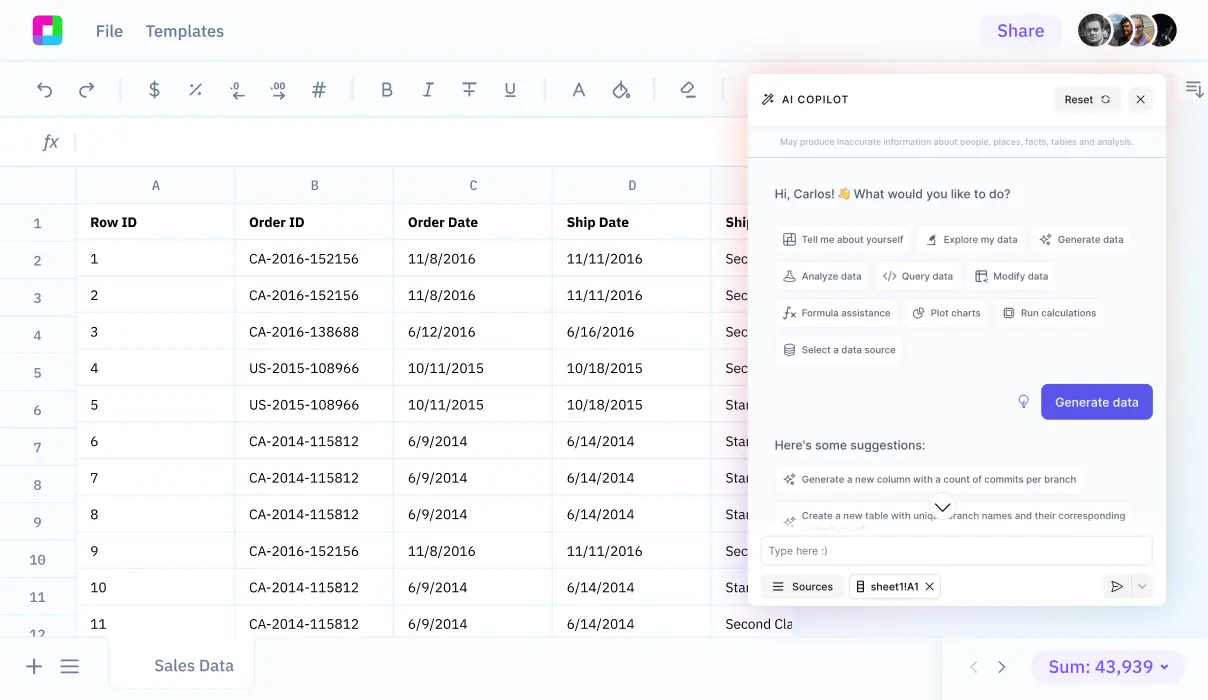

Sourcetable reimagines spreadsheet analysis as an AI-powered conversation. Instead of mastering complex Excel functions, users simply tell Sourcetable what they want to analyze. The platform's AI chatbot automatically handles everything from data processing to visualization, making portfolio analysis accessible to everyone, regardless of technical expertise.

This guide explores how Sourcetable's conversational AI approach transforms portfolio analysis, which you can experience at https://app.sourcetable.cloud/signup.

Why Sourcetable Is the Best Tool for Portfolio Analysis

Portfolio analysis is a critical but time-consuming quantitative technique for evaluating investment portfolios. While Excel relies on complex functions and formulas, Sourcetable's conversational AI interface transforms portfolio analysis into a simple dialogue with a chatbot.

Superior Analysis Capabilities

Sourcetable eliminates the need to learn Excel functions by letting you analyze portfolio data through natural conversation. Simply upload your files or connect your database, then tell the AI what insights you need. The platform handles complex calculations, pattern recognition, and data visualization automatically.

Automated Reporting Benefits

Unlike Excel's manual reporting process, Sourcetable generates portfolio reports through simple conversation. Tell the AI what type of report you need, and it will create stunning visualizations and analysis, ensuring consistency while saving time on manual formatting and calculations.

Enhanced Strategic Focus

By handling technical spreadsheet work through natural language commands, Sourcetable frees portfolio managers to focus on strategic decisions. Whether analyzing performance metrics or generating investment insights, users can accomplish complex tasks by simply describing what they want to achieve.

Portfolio Analysis Benefits with Sourcetable vs Excel

Benefits of Portfolio Analysis

Portfolio analysis provides quantitative insights into asset performance and risk metrics while examining adherence to portfolio objectives. Regular portfolio reviews optimize asset allocation efficiency and reveal key performance contributors and detractors. This analysis supports investment decisions, improves cost efficiency, and integrates with investment and risk management processes.

Advantages of Using Sourcetable

Sourcetable revolutionizes portfolio analysis through its AI-powered interface, allowing users to create and analyze spreadsheets using natural language commands. By simply describing your analysis needs to the AI chatbot, Sourcetable handles complex calculations and data visualization tasks that would typically require manual Excel functions.

AI-Powered Analysis Benefits

Sourcetable's AI capabilities eliminate the need for manual spreadsheet work by automating analysis tasks through conversational inputs. Users can upload files or connect databases, then direct the AI to perform any analysis, create visualizations, and generate insights, making portfolio analysis more intuitive and efficient than traditional spreadsheet tools.

Portfolio Analysis Examples with Sourcetable: AI-Powered Investment Analysis

Sourcetable revolutionizes portfolio analysis through its AI chatbot interface, enabling users to analyze investment data by simply describing their analytical needs. Upload portfolio data from funds like T. Rowe Price Global Growth Equity, BlackRock Total Return, and JP Morgan Emerging Markets, and let the AI handle complex calculations and visualizations.

Key Analysis Types

Through natural language commands, Sourcetable's AI performs quantitative analysis and statistical performance reviews without complex spreadsheet formulas. Users can request risk analysis, performance metrics, and positioning analysis simply by asking the AI chatbot.

Benefits and Features

The platform transforms portfolio analysis by eliminating the need for manual spreadsheet work. Whether analyzing data from uploaded files or connected databases, Sourcetable's AI generates insights, creates visualizations, and identifies optimization opportunities through simple conversation.

Analysis Examples

Analyze portfolios from Baillie Gifford Global Discovery Fund, Jupiter Global Value Equity Fund, and Morgan Stanley by telling the AI what insights you need. The AI chatbot handles everything from data processing to visualization, making complex portfolio analysis accessible to all users.

Portfolio Analysis Use Cases with Sourcetable

AI-Powered Portfolio Creation and Tracking |

Generate portfolio spreadsheets through natural language commands to Sourcetable's AI. Upload investment data files or connect databases for analysis. Track multiple securities and generate real-time performance insights through conversational AI queries. |

Automated Risk Analysis |

Request comprehensive risk assessments using simple conversational prompts. Let AI analyze portfolio risks, evaluate diversification, and assess exposure. Generate risk models and stress tests through natural language interactions with Sourcetable's AI assistant. |

Instant Performance Analytics |

Ask Sourcetable's AI to analyze performance metrics and generate visualizations. Calculate key indicators like |

AI-Guided Asset Allocation |

Use conversational AI to optimize asset allocation based on uploaded portfolio data. Request rebalancing recommendations and tax-efficient strategies through natural language queries. Generate allocation insights and visualizations without complex spreadsheet formulas. |

Frequently Asked Questions

What is Portfolio Analysis and why is it important?

Portfolio Analysis is a quantitative technique that determines the characteristics of an investment portfolio to help investors assess performance, risk, and positioning. It is a key component of investment management, research, and risk management that helps identify areas for optimization and determine if portfolio objectives are being achieved.

What business benefits does Portfolio Analysis provide?

Portfolio Analysis helps companies make data-backed decisions by collecting and sharing real-time data from inside and outside a portfolio. It enables organizations to identify which products to launch, renovate, or retire, while optimizing resources and finances to maintain high ROI. It also helps determine when and where to prioritize product development.

How can I perform Portfolio Analysis using Sourcetable?

Sourcetable is an AI-powered spreadsheet that makes Portfolio Analysis simple through natural language interactions. You can upload any size data file or connect your database, then simply tell the AI chatbot what analysis you want to perform. Sourcetable's AI will automatically analyze your data and create stunning visualizations and charts, eliminating the need for complex spreadsheet functions or manual analysis.

Conclusion

Portfolio analysis provides essential quantitative insights into asset performance, risk metrics, and portfolio objectives. While Excel offers powerful tools for portfolio analysis, including descriptive statistics calculations through functions like STDEV.P and covariance analysis via the Analysis Toolpak, modern AI alternatives streamline this process.

Sourcetable simplifies portfolio analysis by replacing complex Excel functions with an intuitive AI chatbot interface. Instead of manually configuring calculations and formulas, users can simply describe their analysis needs to Sourcetable's AI, which automatically processes data from uploaded files or connected databases. Experience the power of AI-driven portfolio analysis at https://app.sourcetable.cloud/signup.